|

|

Information Letter 14 is, arguably, the most widely-distributed internal memo in the recent history of the computer industry. In November 1990, I took my second six-week leave which, combined with accumulated vacation days, amounted to three months away from the fury of software development. I relaxed (a little), read (a lot), wrote a book “The Hacker's Diet”, and spent a lot of time evaluating the numerous software products which were being launched for Windows 3.0. I quickly reached the conclusion that the issues about which I'd been concerned when I penned my August 1988 “Technological Leadership” memo to Al Green (see page

) were not only unresolved, but in many cases the situation had deteriorated, both internally within Autodesk and vis-à-vis the competition, the evolution of the market, and the expectations of customers.

I wrote Information Letter 14 for presentation to senior management, to spur them from what I perceived as a dangerously complacent view of the software business. With all the turbulence that has ensued since 1991, it's easy to forget that the problems and risks I warned of in Information Letter 14 were little-perceived around Autodesk prior to its appearance. After its appearance, one Autodesk director said of Information Letter 14 “some of it was unfair and a little exaggerated.” Management, who quickly moved to minimise the significance of Information Letter 14, apparently persuaded investors that all was well—whatever impact the release of Information Letter 14 had on the stock was limited to a week or so, after which the stock went to new highs.

Legend has it that Information Letter 14 was “released into the company's E-mail system” as the “ultimate flame mail” or similar nonsense intended to paint me as an irresponsible leader of some kind of underground “cabal” of “Core programmers”. For example, and for a good laugh, see the front-page “profile” of Autodesk in May 28, 1992 issue of The Wall Street Journal, written by hatchet-man Greg Zachary.

What actually happened was that, as I always do, after drafting an early version of IL 14, I circulated draft copies to a few people with whom I'd been discussing these issues over a period of time, to see if they felt the document was complete, accurate, and fair. Unfortunately, I failed to adequately impress upon one of these reviewers the confidentiality of the memo, which was intended first for senior management and then, only later, for general distribution. As a result, copies of the early draft began to circulate within the company and outside, which forced me to quickly issue an official IL14 with at least some of the shortcomings of the draft corrected.

The runaway replication of the unofficial draft meant that the copy most people read was not the final document presented here, in the form I delivered it to senior management on April 1, 1991. The differences were not great, but I consider this version the more accurate in expressing the issues facing the company than the early draft. Information Letter 14 inspired Bill Gates, who described it as “brilliantly written and incredibly insightful”, to write his own Issues and Strategy “crisis letter” in which he said that “By talking about how a large company slows down, fails to invest enough and loses sight of what is important, and by using Microsoft as an example of how to do some things correctly he manages to touch on a lot of what's right and wrong with Microsoft today.”

by John Walker

Revision 24 — April 1, 1991

Here on the level sand

Between the sea and land,

What shall I build or write

Against the fall of night?

Tell me what runes to grave

That hold the bursting wave,

Or bastions to design

For longer date than mine.— A. E. Housman, 1936

I've noticed something odd over the last few months. Whenever I read something written between 1982 and 1988, or reflect upon those years, they seem increasingly distant, foreign, almost quaint. Quaint in the sense the Eisenhower years seemed by 1968, or the earnest hopes of the early sixties from the depths of the mid-seventies. Who would have imagined a few years ago that in the first months of 1991 the news would be filled with a war in which an alliance of the Soviet Union, Syria, Britain, France, Egypt, and the United States used high-tech weapons to flatten an Arab country, of the reorganisation of Europe around a united Germany exporting, among other things, rubble from the Berlin Wall and curios of the departing Red Army, and of a collapsing Soviet Union which even Russia (Russia!) was considering abandoning, careening into a crisis of unknowable magnitude and consequences, spurring sober observers to fear “a nuclear Beirut.”

If the pace of change in the world seems breathtakingly fast and ever-accelerating, developments in our own software industry are even more rapid and revolutionary. Often it seems like the pressing concerns of six or twelve months ago are no more relevant to our current priorities than the Wars of the Spanish Succession or the controversy over N-rays. Compounded exponential growth is thrilling to experience and pays well, but it demands of those who would prosper by it the ability to make ever larger adaptations with less and less time to prepare.

When a company ceases to change at the rate demanded by the industry it exists within, it finds itself rapidly left behind. Before long, its customers discover products of competitors that better meet their needs. As market share slips, sales fall, and earnings decline, the management of the standstill company asks, “What's happening? We're still doing all the things we used to do.”

Surely they are, but that's no longer enough. Times have changed but they did not. Increasingly their company and its products seem like relics from the past, almost…quaint.

I am writing to you because

I am deeply concerned for the future of our company.![]() Autodesk has

been successful over the last nine years because it quickly

adapted to the changes in the marketplace for its products. I believe

we are embarking on another period of rapid evolution in personal

computer software, one fully as significant as that ushered in by the

IBM PC in 1982. That product defined the personal computer software

industry as we know it. The era we're now entering holds unparalleled

opportunity for companies with foresight to anticipate the

transitions and position themselves to benefit, creativity

to build the next generation of products, aggressive management driven

to get the job done and bring it to the customers by energetic

marketing, and the financial strength to accomplish all these tasks

in times of economic uncertainty.

Autodesk has

been successful over the last nine years because it quickly

adapted to the changes in the marketplace for its products. I believe

we are embarking on another period of rapid evolution in personal

computer software, one fully as significant as that ushered in by the

IBM PC in 1982. That product defined the personal computer software

industry as we know it. The era we're now entering holds unparalleled

opportunity for companies with foresight to anticipate the

transitions and position themselves to benefit, creativity

to build the next generation of products, aggressive management driven

to get the job done and bring it to the customers by energetic

marketing, and the financial strength to accomplish all these tasks

in times of economic uncertainty.

Autodesk possesses all the prerequisites to lead the next generation of the PC industry, yet it seems to have become stuck in the past, mired in bureaucracy, paralysed by unwarranted caution, and to have lost the edge of rapid and responsive product development and aggressive marketing and promotion on which the success of AutoCAD was founded.

Not only has Autodesk failed to bring the new products it needs to the market, it is allowing AutoCAD, our flagship product and the source of essentially all our revenue, to become dangerously antiquated and under-marketed to an extent that is virtually unique for a product generating sales in excess of $200 million a year.

Just as the rapid changes now underway hold great opportunity for those who exploit them, they imperil companies which fail to adapt. Among software industry leaders prior to the IBM PC, only Microsoft remained in the forefront in the 1980s. The software battlefield is littered with the corpses of companies who had a great success with one product and then neglected that product until it was eventually supplanted by a new, more imaginative product. CP/M, VisiCalc, and WordStar in the past…Lotus 1-2-3 today…and tomorrow? I believe that unless Autodesk acts immediately and decisively, effecting a rapid and comprehensive top-to-bottom change in what the company believes possible and how it goes about accomplishing its goals, AutoCAD will suffer this same fate, destroying with it all we have worked for so long and so hard, extinguishing forever the promise and opportunity that Autodesk still holds in its hands.

In the early days of Autodesk, I wrote status reports on the progress of the company for employees and shareholders (who were, at the time, the same people). These papers chronicled the triumphs and disappointments, the crises and their resolutions which are part and parcel of building a company. It's been years since I brought my view of the company to you in this way; since I removed myself from management in 1988 I've been concerned primarily with software development and identifying technical directions in which the company should move, not commenting on where it was going or how effectively it was getting there.

But now I feel compelled to speak out. I believe that our company is entering a time of great peril combined with unparalleled opportunity. Regrettably, I do not believe that Autodesk's management is positioning the company to emerge from this period stronger and better equipped for future growth. Indeed, it is my opinion that their current policies place at risk everything we have achieved since 1982.

First a few words about me and my relationship to the company. As you probably know, I initiated the organisation of Autodesk, was president of the company from its inception through 1986, and chairman until 1988. Since I relinquished the rôle of chairman, I have had no involvement whatsoever in the general management of the company. On occasion, management has sought my opinion on various matters, in the same manner they consult others with relevant experience and insights, and from time to time I have volunteered my opinion on various issues, both verbally and in writing. My view has always been one of many inputs weighed by management when reaching their decisions. Over the years I have agreed with many of their choices and disagreed with some, but all in all I felt our company was in good hands. In any case, I never doubted our senior management was doing a better job of running the company than I ever did when I was involved more directly.

Some people mistakenly believe I still “call the shots” in some covert fashion; that despite my repeated and sincere expressions to the contrary, somehow management either rubber-stamps my decisions or grants me veto power over their judgements. Nothing could be further from the truth; were that the case, I would certainly not be bringing these concerns to you today in this fashion. I have raised these issues that trouble me so deeply with senior management repeatedly and forcefully. My premises and the conclusions I draw from them have not been disputed. In fact, on numerous occasions, I was told action would be forthcoming to implement many of my recommendations. But nothing has happened. Well, something has happened: time has passed. And as the months and years go by, the difficulty of refitting Autodesk for the realities of a new era in the software market increases as its importance grows. Inaction in the face of a changing market and world is the chief cause of my concern for Autodesk's future. I see in it the same somnambulistic plodding to the precipice that preceded the demise of so many former leaders in the software market.

Also, let me state unambiguously that regardless of the sentiments I

express herein and the direct manner in which I characteristically

state my opinions, I have no desire whatsoever to see Autodesk's

management removed from their jobs or to resume any rôle in

management myself. What I want is for them to act: to act in

the same way managements of other companies of similar size in

comparable industries facing similar challenges act—to do what is

necessary, not what they've come to believe is possible; to make

the difficult choices they are paid to make and put the company back

on the path to further growth and success.![]() The decisions will not be

easy, their implementation will not be simple, nor will the process be

devoid of pain. But the alternatives are all much worse.

The decisions will not be

easy, their implementation will not be simple, nor will the process be

devoid of pain. But the alternatives are all much worse.

As you may know, for reasons largely unrelated to the matters I

discuss herein, I have decided to permanently leave the United States.

It was my plan to continue my work in software development at

Autodesk's new software development centre in Neuchâtel

Switzerland. That is still my intent, unless Autodesk responds to this

message by silencing the messenger.![]()

Finally, in this paper I will largely focus on AutoCAD, as opposed to the company's other products. First, the simple reality is that AutoCAD is where all the money comes from, and therefore developments which threaten it threaten the company. Utterly botching AutoShade, Animator, or Xanadu would be tragic, but would not bring the company down. Allowing AutoCAD to lose its leadership would. Second, the problems that I see afflicting AutoCAD are the same problems faced by the other products. For a number of years I believed that Autodesk's lack of success with new products stemmed from a dangerous fixation on AutoCAD; no other product received the attention necessary to make it a success because its near-term contribution to revenue was swamped by that of AutoCAD. Now, however, I believe that AutoCAD has suffered from the very same neglect, both in the product development resources committed to it and especially in marketing and sales aimed at expanding its market. The inaction that led to the lackluster performance of AutoSketch and AutoShade after their introduction is today threatening to destroy AutoCAD. The redirection of the company which must occur to rescue AutoCAD will benefit all our products.

It isn't possible to discuss the state of Autodesk and AutoCAD or to adequately describe the competitive risks I believe threaten our company and its products without speaking frankly of the shortcomings of AutoCAD, contrasting it with the products of other companies, and, in pointing out Autodesk's vulnerabilities, providing a roadmap a competitor could use to mount an assault against Autodesk. I have thought long and hard about the risks of bringing such information to the attention of a wide audience; surely, given the first- and second-hand distribution of this document, copies will fall into the hands of the press and competitors. Given that the author is a founder of the company, excerpts may be used in the short term to embarrass Autodesk or to promote competitive products. I have concluded, though, that these risks are unavoidable consequences of placing the issues I discuss here on Autodesk's agenda. If Autodesk acts as I believe it must, it will quickly render impotent competition based on its prior weaknesses. If Autodesk doesn't move to remedy these shortcomings, they will soon (if not already) be sufficiently obvious that competitors won't need me to point them out, nor my guidance to draw plans to exploit them.

Throughout the proposal, organisation, and early operation of

Autodesk, my constant theme, repeated until I'm sure everybody was

thoroughly sick of hearing it, was “the game has

changed.”![]() From the

perspective of 1990, the original concept and mode of operation of

Autodesk seems hopelessly nïve. It would certainly be so today,

were anybody foolish enough to think they could enter what is now a

mature industry in so amateurish a way.

From the

perspective of 1990, the original concept and mode of operation of

Autodesk seems hopelessly nïve. It would certainly be so today,

were anybody foolish enough to think they could enter what is now a

mature industry in so amateurish a way.

But in 1982, I used the phrase “the game has changed” to shock people into realising that even then the stakes were rapidly rising and that to build a successful software company would require funds, commitment, professionalism, and risks far in excess of what previously characterised the personal computer business. Sometimes people forget that personal computers were already six years old when the IBM PC was introduced, and that several companies had grown to $10 million per year or more manufacturing CP/M, Apple II, and other early machines. What had been, in 1977, a game into which anybody with a bright idea and a soldering iron could jump in had, by 1982, become a serious business in which millions were made and lost.

The first PC software fortunes had already been made. CP/M from Digital Research, MicroPro's WordStar, and Visicorp's VisiCalc dominated the software landscape to such an extent that some believed no opportunities remained to found new mass-market software companies.

Yet today, none of those companies commands a substantial position in the market. What happened? The game changed, but they did not. As the game changed, the stakes to stay in it grew enormously and those companies, the former leaders, failed to summon the resources they needed and the courage to deploy them. What one day looked like an utter, unassailable monopoly fully as secure as AutoCAD's grip upon the CAD market evaporated within months at the hands of competitors with products that better served the customers in the new environment. Times have changed; clear the screen; turn the page.

When the IBM PC appeared, the expectations of software customers rose rapidly. Software purchasers would no longer settle for a disc with a handwritten label, a five page manual photocopied from a dot-matrix original, or unreliability of any kind. The standards of quality, professionalism, presentation, and support all rapidly escalated, and those companies who survived were those who realised the bar had been raised and did what was necessary to continue to clear it. Indeed, the great successes of the early IBM PC era: Microsoft, Lotus, and Ashton-Tate, were the very companies that raised expectations through their own products. Since that time, standards have continued to rise and the struggle for supremacy in the mainstream business applications: word processing, spreadsheets, and databases, has largely been contested by increasing product quality, functionality, and customer service.

When major shifts occur in user expectations, dominant hardware and software platforms, and channels of distribution, companies which fail to anticipate these changes and/or react to them once they are underway are supplanted by competitors with more foresight and willingness to act. The displacement of Digital Research by Microsoft, of VisiCalc by Lotus, and the current eclipse of 1-2-3 at the hands of Microsoft Excel are all examples of this process.

It is my belief that AutoCAD as a product, and Autodesk as a company, is poised to lose its market leadership in precisely this manner. Further, I believe this event is overdue and that Autodesk is living on borrowed time provided only by the absence, as yet, of an effective competitive attack aimed at Autodesk's true weaknesses—one coherent with the emerging characteristics of the software market. Today Autodesk is king of the mountain, but it is poised precariously, waiting to be pushed off by any company that seizes the opportunity and acts decisively. One of the largest unappreciated factors in Autodesk's success has been the poor strategy and half-hearted, incompetent execution that characterised most of our competitors in the past. But betting the future of our company on this continuing for another decade is foolish, a needless prescription for disaster.

During the years when AutoCAD pioneered the market for PC CAD, Autodesk constantly innovated in means of distribution, support, training, promotion, applications—every aspect that contributed to the present success of AutoCAD. Today, Autodesk seems frozen in the past, as if the clock stopped sometime in 1987 or 1988. There seems a cargo-cult-like belief that merely going through the motions that worked so well before will guarantee similar success in the future. But we did those things because they were right for the market several years ago, not today. The game is changing again, and Autodesk shows no signs of adapting to the newly emerging era.

What are the characteristics of the software market that is emerging in the 1990s? Sometimes we are so clever in our analysis that we overlook important points simply because they are so obvious. The products that are building new markets today and becoming the new stars of the software firmament are:

Let's look at each of these characteristics in turn.

The most fundamental characteristic of modern software is that it is extensive. Just as the first IBM PC applications dwarfed their 64K CP/M predecessors, modern software exploits the resources of machines with megabytes of main memory and hundreds of megabytes of hard disc: turning the potential latent in that hardware into benefits the user can perceive. This is what I call “the quantity of software in the box,” and it is the most obvious metric of software value per dollar spent.

Here are some data points to ponder, showing the amount of software delivered with each of the following products:

| Product | Size (Mb) | Executable (Mb) |

|---|---|---|

| Dbase III (1985) | 0.5 | 0.13 |

| Lattice C 3.0 (1986) | 1.4 | 0.53 |

| Autodesk Animator | 1.6 | 0.48 |

| Windows Excel 3.0 | 4.6 | 1.95 |

| Word for Windows | 4.7 | 1.32 |

| High C 1.6 | 5.0 | 2.43 |

| Asymetrix Toolbook | 6.5 | 1.18 |

| AutoShade 386 2.0 | 7.6 | 3.74 |

| PowerPoint | 7.6 | 1.30 |

| AutoCAD 386 R11+AME | 8.8 | 4.11 |

| Windows 3.0 SDK | 8.9 | n/a |

| 3D Studio | 9.2 | 1.32 |

| Borland Turbo C++ | 9.3 | 4.14 |

| CorelDRAW! | 14.2 | 3.37 |

| Microsoft C 6.0 | 14.5 | 5.62 |

(These figures were obtained from the size of these products as installed on my Compaq 386. Some products, if installed with different options, can vary substantially in size. For example, when PowerPoint is installed on a system with a Hewlett-Packard LaserJet instead of the PostScript printer I use, it includes special downloadable fonts that increase its size to 18 megabytes.)

The actual executable program, what most folks in software development and consider to be “the product,” is a fairly small component of the total software delivered to the customer. Most of the size of modern products comes from what Autodesk dismisses as “support files” and devotes relatively little effort to: fonts, sample documents, help files, on-line tutorials, on-line documentation, clip art, menus, macros, templates, and so on.

But as seen by the user, these components are just as much a part of the product as the executable program. First users appreciate items like on-line hypertext help and documentation. Then they expect them, and soon they demand them. This kind of massive support around the core of an application is becoming a prerequisite for software products, especially those in large, maturing markets.

Another aspect in which modern products are “big” is in what are called “production values” in the movie business; the appearance of the product, documentation, and packaging. I remain a firm believer that, all else being equal, the product that delivers the greatest functionality and performance to the customer will win out in the end. But there's no law of engineering that requires a powerful product to look crude or behave in a less than civilised manner, as if products somehow derived virtue from the software equivalent of exposed screw heads, sharp corners, and chalky grey paint. Simply compare the appearance of AutoCAD with Excel or Word for Windows. Which product looks like it costs $4000?

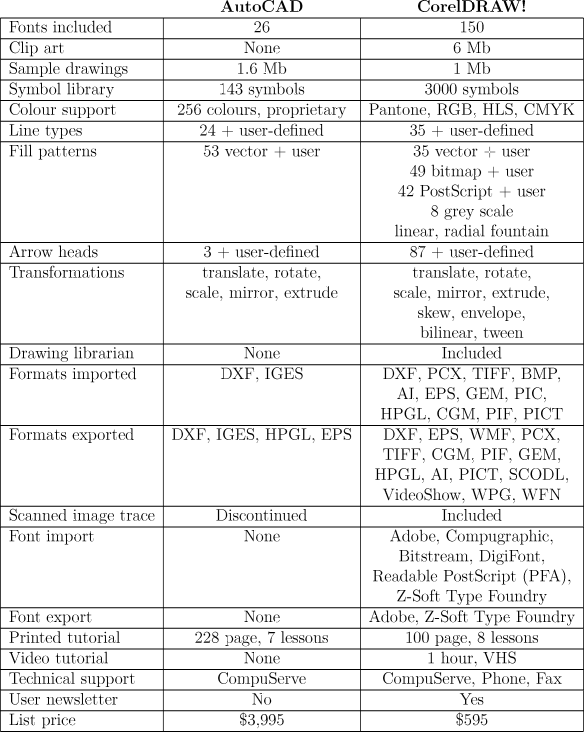

Let us consider an example, quite close to home. Here is a comparison of AutoCAD with CorelDRAW!, a leading 2D drawing and illustration product for Windows.

Now I don't mean to imply by this that there are not many features present in AutoCAD that CorelDRAW! lacks. CorelDRAW! is an illustration tool, not a CAD system. It is totally two-dimensional (other than simulated 3D special effects), lacks dimensioning capabilities, has nothing resembling object snap or other geometry-driven constructions, does not support digitising tablets for precise co-ordinate input, and has no macro language, user defined objects, or other facilities permitting it to serve as the basis of applications.

My point is this: there is nonetheless a large overlap between CAD and illustration. Despite the pretensions of CAD systems to be seen as modeling tools, the end product most CAD systems in the hands of most CAD users is marks on paper. Consequently, a CAD product such as AutoCAD and an illustration product like CorelDRAW! will, of necessity, provide many of the same capabilities. And within that large common area, among all those features these two products share, CorelDRAW! surpasses AutoCAD in every single one, in some cases overwhelmingly. In appearance and ease of use AutoCAD is totally blown away.

You might be tempted to respond by saying, “Well, nobody in his right mind would buy AutoCAD to do illustration, and AutoCAD's geometric construction, dimensioning, multi-view plotting, and layer control still make it far more productive for CAD, even in 2D.” I agree. But you'd be missing the point. Just because a product provides a larger set of more complicated features is no excuse for botching the simpler, basic stuff, for allowing the functions that constitute the meat and potatoes of all drawing to be inferior in scope, shrouded in an opaque, obscure, and antiquated user interface, and incapable of exchanging data with other applications in widely-used, contemporary formats.

I've discussed CorelDRAW! in some detail because, as a drawing tool, many of its features are directly comparable to AutoCAD. I've grown more than a little tired of hearing AutoCAD developers burst out laughing or dismiss as impossible capabilities present in a product that sells for a fraction of AutoCAD's price. That many people aren't aware of such products disturbs me; that some are and don't seem to care I find appalling. CorelDRAW! is not an isolated example; it is typical of the modern generation of applications, especially in the rapidly-expanding Windows sector. These applications, including products such as Microsoft's Excel, Word for Windows, and PowerPoint, embody a breadth in the scope of the software, a depth in the supporting materials supplied with it, and appearance and other fundamental production values that make AutoCAD look, if not amateurish, at least antiquated.

Restricting the comparison among products to executable file size gives lie to a widely-shared misconception about AutoCAD (and oft-cited excuse for its feature shortcomings, slow development cycle, and inflexibility): the claim that it is a “big, complicated program”—one that strains every limit of the personal computer and embodies not only more complexity, but simply more code than other widely-used applications. Perhaps this used to be true, but it isn't any more. As the pace of AutoCAD development has slowed (in my opinion, due to the meager human resources devoted to it), other products have been catching up and, in some cases, surpassing AutoCAD. The executable sizes in the table above include utilities, translators, and in the case of AutoCAD, both AME and AME Lite. Here is a table that compares just the core executables.

| Product | Core Executable (K) |

|---|---|

| PowerPoint | 859 |

| Word for Windows | 894 |

| CorelDRAW! | 904 |

| Asymetrix Toolbook | 1,176 |

| Windows Excel 3.0 | 1,254 |

| AutoCAD 386 R11 | 1,815 |

While at first glance AutoCAD might appear to have an edge, note that AutoCAD is the only program on the list compiled in 32-bit 386 mode, which is substantially less efficient in code and data space. In addition, the other applications inherit their low-level drawing and user interface management from Windows, whereas AutoCAD includes its own facilities for these functions. In an era when AutoCAD can not only be run on a laptop computer, but developed on one, the constraints on its growth appear a matter of priorities rather than technology. The reality is that AutoCAD is, today, a medium-sized application and will, in the future, have to become much larger to keep up.

Most current software products sell at price points ranging from one sixth to one eighth the price of AutoCAD. Around Autodesk it's sometimes easy to forget just how high the price of AutoCAD is. Also, there's a tendency to forget that this wasn't always the case. When AutoCAD was introduced, it was priced at $1000, and for much of its history it sold for roughly $2000. This was a premium price, but much closer to the mainstream of contemporary software.

In fact, the combination of AutoCAD's high price and high volume is, to my knowledge, unique in the industry. Software this expensive tends to be semi-custom products or packages that address a small vertical market, not something sold by dealers with an installed base numbering hundreds of thousands.

Any company able to command a premium price should feel gratified; it's the ultimate verdict of the market on the quality and utility of the product in question. However, when the premium approaches an order of magnitude above other products with similar or greater development investment and, at the same time, dealers find it increasingly difficult to sell the product at anything approaching the recommended retail price, it's time to ask the following question.

“What price point for AutoCAD generates the maximum revenue and profits for Autodesk and its distribution channel?”

I'll skip the refresher course on price elasticity curves from Econ 101. Just recall that beyond a given point raising the price of a product reduces revenue by causing volume to decrease. In the longer term, overpricing renders a product vulnerable to lower-priced competition.

In an environment where concerns about grey market distribution, software piracy, health of the dealer channel, faltering sales growth, and worries about margins abound, it would seem wise to revisit the question of AutoCAD's price and ask whether it is consonant with the pricing of software products which will maintain and expand their leadership in the 1990s.

Modern products are heavily advertised in a wide variety of media, and are available through a multitude of distribution channels. By contrast, Autodesk is committed to reducing the number of outlets where a customer can purchase AutoCAD. Again, one must ask whether this policy, adopted with the goal of protecting the dealer channel which has been responsible for a large part of Autodesk's success in the 1980s, will in the long-term, benefit Autodesk or its dealers.

Our policy, “AutoCAD is sold by authorised dealers” has been in effect for so many years and has been defended with such vehemence that sometimes we forget that we never planned it that way. When we started the company, software distributors and publisher/distributors were seen as the primary channels through which software developers would move their products, with sales occurring either directly by the distributors or through local retail computer stores who bought products at wholesale from them. At the same time, retail chains such as ComputerLand, MicroAge, and later Businessland were negotiating corporate arrangements with software vendors to buy centrally for their stores. Finally, many of the computer companies then jumping in to compete with IBM in the burgeoning PC market, including Texas Instruments, NCR, Victor, Wang, NEC, AT&T, Zenith, and Fujitsu were building software distribution channels alongside their hardware sales network (recall that this was years before the “clone” market emerged, so special versions of each software product had to be prepared for each of these computers).

As we were gearing up to launch AutoCAD, we were developing contacts in these three primary channels: distributors, retail chains, and computer manufacturers. After we announced the product, only the manufacturers seemed interested. The distributors and chains didn't see enough volume in an odd “vertical market engineering package” to justify carrying it, but many of the manufacturers saw AutoCAD as a product that would showcase the better graphics and greater speed their machines offered compared to the IBM PC.

And then a funny thing happened; the phone started to ring. After the first couple of articles about AutoCAD appeared in the PC press, customers started walking into computer stores and asking for it. The stores called us. We signed them up and called them “Authorised AutoCAD Dealers.” As our dealer channel continued to grow, principally through individual dealers taking the initiative to contact us, we continued pursuing the manufacturers with some success and the chains and distributors with next to none.

Finally, a few years later, the chains and distributors started coming to us, having discovered that many of their stores had signed up directly with Autodesk as AutoCAD dealers. We looked long and hard at the deals they were proposing and did business with some of them, but essentially what they were looking for was a cut on the AutoCAD volume their customers were already selling. We didn't see much benefit in this either for Autodesk or for the dealers who were already selling our product so, in most cases, we declined such distribution deals. (The whole story of the twists and turns as Autodesk evolved its reseller strategy is far more complicated than I can relate here. I've tried to capture the main flavour of it, and hope those whose favourite milestones I've omitted will understand.)

By 1985, a structure much like the present one was in place, with Authorised Dealers selling most of the product, a Fortune 500 program getting underway, and a thriving grey market in AutoCAD that we were trying to stamp out in every way we could manage. And there it has pretty much stayed until now, with relatively minor adjustments through time.

The association of AutoCAD with dealers wasn't something we planned. It just happened, to the great benefit of both Autodesk and our dealers. In retrospect we can see why. In the early days of AutoCAD, just collecting the pieces of hardware needed to run AutoCAD, getting them all to work together, installing AutoCAD on the system and tweaking it to deliver acceptable performance on machines that ran anywhere from 10 to 50 times slower that the typical AutoCAD platform today took a great deal of knowledge and no small amount of work. The drafting plotters that can be bought by calling a toll-free number today were, in those days, sold as specialty items by Hewlett-Packard offices; retail distribution for such hardware had never been contemplated. So it was also for large digitising tablets, high resolution graphics boards, and large monitors.

In order to assemble a working AutoCAD system from scratch a user would have had to become, in a real sense, a computer expert. Far better, especially for a person seeking only increased productivity in drawing, to pay a dealer to put all the pieces together, shake it down into a working tool, and install it along with training to bring the user up to speed. All these tasks the dealer did for the user constituted the “value added” by the dealer, for which the customer paid when he purchased AutoCAD and the hardware at retail, rather than the dealer price.

To a lesser extent, the same could have been said about all other PC applications at the time. Today it might seem absurd to need professional help getting a word processing system running, but only by people who've forgotten some of the horrors that were sold as printers in the early 1980s, or who think of a hard disc as something you can rely on day in and day out. Those days, computer stores helped ordinary people, unskilled in the strange ways of computers, put computers to work in their homes, offices, and workshops.

Then, as the years passed, computers improved. Not only did the absolute price of computers fall while their performance grew, they became more reliable and manufacturers learned to tailor them better to the needs of specific target markets. In addition, the IBM PC clone emerged as an industry standard architecture. This eliminated many of the compatibility problems that bedeviled the industry previously, especially in software. Now it really was possible to take a computer out of the box, load up WordStar or Lotus 1-2-3, and get right to work.

Inevitably, it wasn't long before customers began to ask themselves, “If all it takes is opening the box and plugging it in, why am I paying this guy at the computer store a thousand bucks to do it?” And soon the first headlines about computer stores going out of business began to appear in the industry press. The customer shopping for a PC or software could readily compare the prices quoted by the mail-order merchants who advertised in the back of all the computer magazines with the stickers at the computer store and, since the products involved had become commodities with reputations based upon their manufacturer's position in the industry rather than the recommendation of a local dealer, saw no reason to pay the premium demanded by the local dealer.

Over the last few years the local computer store, as envisioned in the early 1980s and common in the middle of the decade, has largely vanished. Computers are still sold locally, but frequently much in the same manner as televisions and other electronic appliances, with less markup for the reseller. With constant competition from nationwide mail-order distributors, there's little room for the local retailer to increase his price. Software distribution has changed as well. If hardware has become a commodity, so even more has software. A dealer can add value by unpacking a computer, installing the operating system, adding memory chips, and so on, but each copy of Excel 3.0 is just like every other. Since they're interchangeable, and software installation these days usually consists of “stick the little square thing in the slot and type A:SETUP,” there isn't any reason to pay a penny more than necessary for the product. Consequently, the prices charged for software by direct marketers, discount retailers such as Egghead, and other volume channels are remarkably similar and represent a small margin compared to that of a dealer selling at retail a few years ago.

Once the value added by a reseller begins to disappear, what does a manufacturer gain by restricting the distribution of his product to those resellers? Clearly, withholding the product from mass distribution protects the resellers and helps to maintain the dominance of the product within that channel. By preserving a local sales and service network, the need for direct customer support is reduced, lowering the manufacturer's overhead. Finally, a dealer network, properly supported and directed, can act as a nationwide sales organisation for the manufacturer—one that doesn't come out of his marketing and sales budget.

These are powerful arguments, and Autodesk's success has demonstrated the importance of local presence through dealers. But, as with every other aspect of our business, we must periodically inquire as to the health of our dealer network, and whether Autodesk and the dealers who sell its products can continue to prosper in the coming years as we have in the past.

Here I find serious causes for concern. Compared to the typical desktop computer, an AutoCAD machine is bigger, more complicated, and harder to install and optimise, and the same can be said for AutoCAD compared to most other software. But, just as the passage of time and the evolution of the industry eliminated the need for special skills to get a simple PC running, today they are doing the same for CAD. One can turn to an advertisement and order, with a single toll-free telephone call, a ready-to-run CAD system composed of nationally marketed and serviced components, a system one can fully expect to work as soon as it is plugged in. What then is the value added by an AutoCAD dealer?

I think the shrinking margin between the price at which Autodesk sells AutoCAD to its dealers and the price dealers are able to obtain for it from customers (the so-called “street price”) reflects the perception on the part of AutoCAD buyers that many dealers are doing little more than passing the product through their hands, and thus deserve only a small markup. In such a situation, trying to raise the average retail price by limiting distribution and pursuing “grey marketeers” is like trying to stop the tide with a teaspoon and a sponge; it's setting yourself against the judgement of the market, and it never works, at least not for very long.

A product becomes a commodity when purchasers discover it meets the definition of one: interchangeable, readily available, and sold at approximately the same price by all vendors. Once these conditions are met, there's nothing the manufacturer can do to change the situation. Nothing, that is, that doesn't harm himself. For what possible benefit could there be in making the product harder to obtain, more difficult to put into service, of unpredictable composition, or capriciously priced? Even if a manufacturer succeeded in driving up the retail price by curtailing supply, the effects would, in all likelihood, be short-lived since a sudden, steep rise in the price of a popular product, combined with its disappearance from many channels of distribution would send the clearest possible signal to competitors that here was a market begging for a readily available, more affordable alternative.

It's no secret that many of Autodesk's dealers are encountering difficulties at present, problems that in many cases began well before the current economic downturn. AutoCAD is the last major software product to retain dealer sales as its only channel of distribution. If the problems in the dealer channel are not transient, but instead indicate that dealers can no longer build a profitable business selling AutoCAD, Autodesk could be left in the position of controlling a channel of distribution which was no longer viable. This would leave the field open for other CAD products to establish themselves in the mass market channels where AutoCAD is not for sale.

Something is happening in our industry, something very important, and we would be wise to recognise its significance and take account of it in our plans. The advent of the IBM PC in 1982 forever changed the nature of the PC software business, even though many software companies didn't realise it at the time. (Autodesk certainly didn't: we spent at least as much effort on CP/M-80 and CP/M-86 machines in the first two years as we did on the IBM). Today, the shape of the industry is again being changed by the emergence of a new standard application platform defined, this time, not by hardware but by software—Microsoft Windows.

Just as there was nothing “new” about the IBM PC in 1982; 8086 and 8088 machines with similar capabilities existed years before, there is nothing at all new about Microsoft Windows except the way the market has embraced it. But that's all that really matters in the long run. Whether you're a Macintosh fanatic, a committed NeXT developer, an OpenLook advocate, or a Silicon Graphics believer doesn't change this fact: more than eight million copies of Windows are expected to be sold this year, and that estimate may prove low since rumour has it more than half that number were sold in the first 90 days of 1991.

Whether it's ugly or beautiful, naughty or nice, good or evil, when a product gains that kind of momentum and enlists that many users on its side, software developers had better start paying attention to it. Consider this: foremost among the companies who desperately hoped Windows would never take off was IBM—an outfit known to have some clout in the marketplace and reputed, by those who dislike it, to be able to persuade people to buy almost anything. Yet even in the Fortune 500, the very heart of IBM's market and the segment it influences most strongly, Windows is spreading like wildfire, brushing away OS/2 as if it had never existed.

Unlike the Macintosh, which has suffered from a premium price, single source, and worries about connectivity, Windows allows a DOS user to upgrade for less than $100 and continue to run all his old software. This both contributes to the rapid adoption of Windows and reinforces users' demand for truly integrated applications; once Windows is on your machine, the distinction between programs that understand the clipboard, system fonts, system printer, and all the other Windows services and those that go boinggg!!! and blop out to a dumb old DOS character screen becomes glaringly evident. This makes getting caught out without a Windows version of your program just about the worst possible thing that can happen to a DOS application vendor these days. Just look at the increasingly desperate and strident promotions being unveiled by Lotus to try to maintain sales of 1-2-3 as they feverishly debug their Windows-based reply to Excel.

All of the dynamics that made the Macintosh market so special, that made Macintosh users so unwilling to consider any alternative, are now being ignited by Windows in a market ten times larger. A community of users ten times the size of the Macintosh, Amiga, Sun, and NeXT user base combined is now beginning to discover, albeit in a cruder way, what possessed people to buy those other systems. You don't have to predict the future to see the Windows phenomenon, you need only open your eyes. Consider this: Windows, like the Macintosh, lets you attach a little icon to an application. Users can make their own icons and customise their systems that way. Proud of their artistry, many users upload their spiffiest new icons to CompuServe and other networks so others can share them. The last time I looked there were, sitting on CompuServe, a total of 1.3 megabytes of Windows icons ready to download. These aren't the applications, just the icons—a total of 1700 of them, including five each for AutoCAD and Generic CADD!

A market ten times the size means ten times the money to be made by application vendors, and if that weren't incentive enough, it's a market that, with each installation, displaces a raw DOS machine. Certainly Windows continues to suffer some technical shortcomings: it only allows 16 bit applications (unless heroic effort is exerted, as in the case of Wolfram Research's Mathematica), it is essentially a single-tasking system, and it inherits all the shortcomings of the MS-DOS file system. All of these limitations are, however, scheduled to be remedied over the next two years. Given the importance of Windows to Microsoft's strategy and the resources they commit to such projects, Windows buyers can be reasonably confident the schedule will be met. And even if it isn't, Windows 3.0, as it stands today, is far and away the best environment you can choose without throwing away your DOS hardware, and that's an option most users can't afford, even if they were inclined to.

In addition, there's an effort underway by Microsoft, Compaq, and others to make a machine-independent version of the Windows-OS/2 environment and use it to enter the workstation market. While there's room for many a slip in such glib and grandiose plans, if I were Sun I'd be more than a little worried about the prospect of twenty or thirty companies cranking out RISC machines that ran a user interface already known by twenty or thirty million people, one to which application vendors could port their software to simply by recompiling.

What I'm suggesting is that Windows is a Big Event—the kind of thing that happens every decade or so in our industry that establishes a new baseline from which future evolution builds. Events of this nature reward those who move quickly enough to exploit them and winnow out others whose attention is elsewhere, who underestimate the significance of the change, or cannot react in time. Big Events force those who wish to survive to revisit their strategies and question long-term plans. This process requires flexibility in an organisation which is difficult to maintain after it has grown enormously in size and become set in its ways.

One central and virtually unquestioned tenet of Autodesk's strategy has been “platform independence.” That means, with very few and very limited exceptions, we do nothing on any one machine that cannot be done on every machine that runs AutoCAD. This forces us (some would say “gives us a handy excuse to”) exclude support for many facilities on machines like the Macintosh which virtually all other applications, even the least expensive, furnish. The facilities provided to the AutoCAD user become, in a large sense, limited to the least common denominator of those provided by all the machines we support and look, consequently, crude next to applications closely tailored to a specific system. When we feel compelled to address a glaring shortcoming, such as lack of support of system menus and dialogues, we're forced into a much larger project such as Proteus, since our solution must work on every machine and operating system, not just one.

Severely limiting the integration of AutoCAD with various operating environments hasn't hurt us so far, I believe, primarily because the systems that account for the overwhelming percentage of our sales: DOS and 386 DOS, also happen to be the least common denominator in virtually every aspect. Consider all the things we could have done to make AutoCAD faster and easier to use if we hadn't required everything to run in 640K of RAM. Regardless of your opinion of our Macintosh version of AutoCAD, or your view as to how we might have proceeded in that market, the fact is that regardless of whether we succeeded beyond our wildest expectations or failed to sell a single copy of AutoCAD for the Macintosh, our financial results wouldn't have changed much. That doesn't mean we shouldn't have put AutoCAD on the Macintosh, or that we shouldn't continue to strive to better integrate AutoCAD into that environment (I'm the guy who first managed to get AutoCAD running on the Macintosh, you'll recall); all I'm saying is that Apple's market share is simply too small to have much of an effect on our sales (especially when you only count machines capable of running AutoCAD), and rapid expansion of the market generated by AutoCAD is unlikely as long as the Macintosh suffers in price/performance against 386/486 and Sparc machines.

Windows, however, is changing the rules in the very heart of the AutoCAD market. We will, certainly, ship a Windows version of AutoCAD before too many months pass, and we will upgrade that initial product to take advantage of the new versions of Windows now in the pipeline, but I think we have to revisit the level of support we're planning for Windows. Our Windows product will be integrated with Windows roughly to the extent our Macintosh product conforms to the Macintosh environment, which is to say somewhere between “somewhat” and “moderately.” Certainly it will be obvious to any user that many rules change when the mouse strays into the AutoCAD window. This situation has almost certainly hurt us in the Macintosh market, but due to the limited size of the market and the fact we didn't have any sales there to begin with, hasn't become a company-wide priority to fix. I believe that a similar failure to comply with ground rules for Windows applications may hurt us severely, and every week that passes without our thinking about how to address this problem adds to the danger.

(I would hope that whatever we do to allow AutoCAD to fit comfortably into Windows will also let us conform as closely on the Macintosh, OpenLook, NeXT, etc. However, if forced to choose between close integration with Windows now and all-platform user interface support in 18 to 24 months, I'd do Windows first and worry about the others afterward.)

I believe that a CAD product with these characteristics: big, cheap, widely available, tightly integrated with its host system, and promoted and marketed in an aggressive manner could, in relatively short order, displace AutoCAD from its current dominance of the CAD market. AutoCAD would not be eliminated, any more than Lotus 1-2-3 has vanished in the face of competition from Excel, but it would be placed in the same difficult position: forced to play catch-up against the more modern product, trying to reverse an erosion of market share against a newer product with momentum on its side.

Autodesk has the capability today, by making a series of decisions at the level of senior management, to bring the first totally modern CAD product to market. Success in this endeavour would protect Autodesk but, most importantly, would position it to resume its growth into new markets and applications: the broadening of the market that accounted for much of our success in the last decade. Failing to take these steps will, in my opinion, leave AutoCAD a sitting duck waiting to be picked off by the first competitor who launches the product that AutoCAD could have been. How long might Autodesk have before that happens? There's no way to know, but betting the company on it not occurring is hardly a prudent strategy, or indeed any strategy at all. Ponder this: in my opinion, the magnitude of work involved in adding AutoCAD's capabilities to an application such as CorelDRAW! is roughly equal to that of adding CorelDRAW!'s facilities to AutoCAD. Further, remember that a competitor is free to target the lucrative heart of the AutoCAD market, not being saddled with the baggage of compatibility with prior releases, unprofitable hardware platforms and operating systems, niche applications, and characteristics of our distribution channel that constrain Autodesk's freedom of action.

Problems are only opportunities in working clothes.

— Henry J. Kaiser

The large scale, value per dollar, wide distribution, and strong marketing of the new generation of software products reflects ongoing changes in the way the software industry goes about its business. As markets have broadened, revenue has grown, and companies have matured from small bands of moonlighting entrepreneurs to members of the Standard&Poor's 500, the scale of the resources they invest both in the development and launch of new products and the ongoing support of already-successful products has grown apace. Notwithstanding the inefficiencies inherent in doing things on a larger scale, the fact remains that a major release of a modern software product simply reflects many more man-hours of labour and dollars of capital investment than products of a few years ago. There is a lot more software in the box, software that meets or exceeds the ever-rising expectations of an increasingly discriminating community of users, because more people worked more hours using better tools to put it there, and when that software reaches the market, it is supported by a vigorous, comprehensive, and thoroughly professional promotional campaign, both at the time of introduction and throughout the subsequent product life cycle.

Except at Autodesk, where I believe this process has broken down.

Consider this: open the AutoCAD box, the actual commodity that changes hands when a customer buys our product from our dealer. Take out all the pieces, then go back through the product release notes, the documentation review routing slips, and the like, and make a list of the names of individuals whose work directly appears in that box—the originators of everything that eventually ends up in the hands of the customer. When I do this, I come up with about 15 names. It's no wonder we never seem able to deliver what we would like to on a schedule we can live with.

I do not mean to imply that only 15 people are responsible for AutoCAD, or to disparage in any way the efforts of the much larger number of individuals in quality assurance, development test, product management, marketing communication, or other aspects of product development: these are just as essential as writing software, producing documentation, and assembling the support materials that constitute a product release. But they don't wind up in the box! When the customer takes delivery of the product and unpacks the box, he doesn't see any of those other efforts. He assumes adequate resources have been expended to insure the product is reliable, not the least since he parted with such a large wad of cash to acquire it. He relies upon the integrity of the product's vendor to protect his investment through upward compatibility and cross-platform data interchange. He expects the vendor's financial strength, management resources, and commitment to future development will ensure the company can continue to meet his future needs. But at the moment, once the shrink wrap has been discarded and the floppies copied to the hard disc, all that the user sees, reads, and uses is what was in the box.

Written by about fifteen people.

Is this an appropriate development commitment to a product that is generating on the order of two hundred million dollars per year in sales, a product that commands an overwhelming share of a rapidly growing market?

Modern software has so much in the box because more people are working to put it there. Mythical man months and mystical management aphorisms aside, if you stack a development team of 15 people up against a Microsoft-sized project with a hundred or more people directly contributing components that the user will encounter in the product, the tiny team, however bright, however motivated, however hard-working, will always come up short. Especially if the team of 15 people is only allowed to work on the product for a few months per year, conforming to product release schedules proclaimed by accountants (as is the case for Release 12), not by sales, marketing, development, or (perish the thought) the needs of customers.

But doesn't increasing the number of developers, writers, and the like require corresponding increases in the number of supervisors, managers, testers, spec-writers, and everybody else involved with the product? Yes, of course it does. Doesn't that increase costs far beyond even the already large costs of a big development team? Naturally. That is the way the software industry works these days, and it is the investment required of all companies that wish to remain leaders.

But, can Autodesk afford it?

Out of two hundred million dollars a year?

Autodesk has inherited many things from its history, not least of which is the tradition of the “hungry rat,” a reputation as a lean, mean competitor that consistently did more with less through imagination and sustained hard work. This mode of operation was essential when there wasn't anything but imagination and hard work from which to forge a company. In the absence of market share, distribution channels, reputation, financial capital, or a community of users, you fall back on what remains. This way of doing business took us very far. Indeed, it took us all the way to the last quarter of fiscal 1991 with an unbroken streak of rising sales and earnings. But I fear it can no longer guarantee the future of AutoCAD in an increasingly sophisticated market. I believe it is burning out our best people and ensuring the eventual eclipse of our principal product.

Not only are development resources committed to AutoCAD inappropriate to its sales, market share, and importance to the company, the visibility of the product in the marketplace, the ultimate result of Autodesk's efforts in marketing and sales, is unseemly for a product of its stature. Autodesk, once renowned for its innovations in marketing and sales, seems to have settled in recent years for a policy of “All the same things, and less.” Divide Autodesk's history into two parts at the halfway point: sometime in 1986. How many new initiatives in marketing and sales have been launched in the latter half?

Autodesk's penchant for abandoning products developed at great cost at the very moment of shipment has long been a source of frustration for me. AutoSketch was the first example of this sorry tradition, and even though our neglect of that product later forced us to spend millions of dollars to buy Generic Software to guard the low end of our market, that didn't keep us from launching both CA Lab and Chaos, The Software with a marketing budget of essentially zero. In fact, it was only after I offered to pay for the advertisements myself that a small sum was disgorged to advertise CA Lab in the issues of Scientific American and Discover which each devoted a page or more of editorial copy to the product.

The very existence of the Multimedia group is an admission of the neglect for Animator after its hugely successful initial launch. If Autodesk had, in 1983, treated AutoCAD the way it treated Animator and 3D Studio after their introduction, Autodesk would not exist today.

But while any number of reasons can be advanced for neglecting products which some view as distractions from the central business of the company, indulgements of certain influential people, when AutoCAD suffers the very same neglect in the marketplace, the reasons become much more inexplicable and the potential consequences more dire.

But aren't we spending lots of money on marketing? Well, I don't see the budget numbers, but I believe we are—just look at the phone list and make a body count. But the issue isn't how much you spend, it's what comes out; the equivalent in marketing of measuring development by what goes in the box. This metric reveals the extent to which Autodesk has abandoned AutoCAD, ceding by default the position its preeminence in the market merits to any competitor willing to assail it, leaving the customer perception of the product in the hands of reviewers, analysts, and the authors of books.

Is this an extreme statement? Yes, it is. But I believe it accurately reflects an extremely dangerous situation. I don't understand the logic behind spending $400,000 developing a product like Chaos, then allocating essentially zilch for marketing it after all the development cost is sunk. Such a policy makes failure of the product a self-fulfilling prophecy, or at least treats recovering the investment as a crap shoot on users spontaneously stumbling over the product. If you want to save money, don't develop the product in the first place! But don't wimp out at the instant the product has a chance to recover its costs and turn a profit.

But I digress. You probably don't care about Chaos. Let's look instead at a $20 million investment which has been abandoned in precisely the same way. I am talking about AME—our only entry in the solid modeling market, the very cutting edge of the mechanical engineering sector, which everybody says is the largest component of the CAD industry and the one at which we are most at risk.

Twenty million dollars? Well, add up what we paid to acquire Cadetron in the first place, the money we spent subsequently bringing AutoSolid to market, the costs we incurred closing the office in Atlanta and moving development to Sausalito, the subsequent investment in AME/Eagle leading to its shipment with Release 11, and I suspect you'll come up with a figure about that size.

I can't be totally disinterested in the fate of AME since, by building the initial prototype in July of 1989, I played a rôle in the transformation of AutoSolid from a $5,000 stand-alone product targeted at mechanical designers into a $500 component of AutoCAD addressed to a much broader market. I initiated that project because I thought it was a way to rescue a project I thought was going nowhere by aligning it with the way Autodesk has always done business. Rather than addressing a small market with an expensive product (by the standards of PC software), we could bring solid modeling within the reach of anybody who could afford the price of AutoCAD. My goal at the time was to “Within one year, sell more solid modeling systems that exist on the entire planet today.”

Well, it took longer than I expected (everything does), but the Eagle group pulled it off, delivering, the day AutoCAD Release 11 shipped, a solid modeling extension that was far more comprehensive and ambitious than anything I had contemplated as an initial adjunct to AutoCAD.

And then…? Silence.

Where was the large-scale, high-profile, roll-out of what could easily be adjudged the single most significant event in desktop design since 3D? Where were the advertisements and brochures that properly heralded it as a price/performance breakthrough comparable to the introduction of AutoCAD in 1982? Something like:

“AutoCAD's OK, but what have you done for me lately?”

How about solid modeling for $500?

For years, designers have struggled to build complex models of three dimensional objects. Repeatedly, they have begged for relief from arcane commands, obscure terminology, and facilities that seem designed more to humble the design professional than to help him. “Why can't I have a system that works like the real world, one that lets me bore holes, mill, weld, and assemble pieces from parts with operations I can understand?”

“Because that would take solid modeling!” was the answer. “That's a sophisticated technology, suitable only for high-end mechanical engineers, far too costly for your needs and requiring much more computer than you could ever afford.”

Until today. With the shipment of AutoCAD Release 11, Autodesk announces the Advanced Solid Modeling Extension, which delivers true, thoroughly professional solid modeling as an integral component of AutoCAD. And, in keeping with Autodesk's commitment to its customers, it runs on the same affordable machines that run AutoCAD, costs less than $500, and, through open architecture, encourages users to build application systems upon it.

CAD before AutoCAD was an elite club, foreclosed to the vast majority of designers who couldn't afford expensive mainframe computers. Just like solid modeling before today. With AutoCAD Release 11 and ASME, we're putting an end to that, forever. Welcome to the golden age of engineering.

This was how we announced AME in the Release 11 press release of October 18th, 1990.

AutoCAD Release 11 supports the optional Advanced Modeling Extension (AME) which gives designers and engineers powerful constructive solid geometry capabilities that are completely integrated within AutoCAD. With AME, designers can create complex, three-dimensional models by constructing them from simple 3-D shapes.

If this were any more low key, it would be apologetic.

The following sentence closed the paragraph on AME that appeared on the second page of the Autodesk Designer, a flyer mailed to Autodesk dealers, dated October 15th, 1990. AME appeared next to last in the list of Release 11 benefits, right before “Personalisation.”

AME's price, US$495, is unprecedented for solid modeling software, and is sure to introduce the benefits of solid modeling to a wider customer base, especially in the mechanical engineering market.

Well, gosh, I couldn't have put it better myself, but the very tone of this sentence, examined closer in the context of the rest of Autodesk's promotional material, speaks volumes about the assumptions that underlie Autodesk's do-nothing posture toward its products. Indulge me for a moment while I stick this sentence with a pin and pick it apart under the magnifier. “AME's price…is sure to introduce the benefits of solid modeling to a wider customer base….” Precisely how? What is the chain of cause and effect? How does the price act to introduce the benefits. The price, in other words the mere event of Autodesk's making the product available, is seen as an actor in the market, empowered somehow to set in motion the events Autodesk wishes to transpire.

This isn't putting the cart before the horse; it's expecting the cart to go with no horse at all. A low marginal price creates the conditions under which Autodesk possesses an opportunity to transform solid modeling from a highly specialised niche market into another widely-used application like AutoCAD and perhaps, by doing so, to break down the barrier that has kept most designers from truly entering the world of three-dimensional modeling, creating, in time, a market for additional design tools as large or larger than the current AutoCAD drafting market. All the work that went into AME from the inception of The Engineer Works at Cadetron in Atlanta through the breaking of the champagne bottle on the UPS truck the day Release 11 left Sausalito created only the potential for success, conditions that were necessary but not sufficient.

For all the wonderful things to happen which so many people worked to bring about, a few more links in the chain of causality need attending to. Users must learn of the existence of the product. Its benefits must be explained to them. They must understand both what it can do and its limitations. And they need the opportunity to evaluate it for themselves.

These are all the things we had to do between 1983 and 1985 to convert the potential of AutoCAD, the computer program, into the success of AutoCAD, the new world standard for CAD. Having achieved success once does not grant us a license to succeed with additional products, whether related to AutoCAD or not, without doing all the same things we did to bring AutoCAD before its potential customers.

Yet today, Autodesk attends fewer trade shows, garners less press, communicates less frequently and in fewer ways with its user community. What other software company comparable to Autodesk has no user newsletter? What other software company refuses to provide technical support to users in need?

There is a dangerous myth that because we have a reseller channel, we needn't do the things other companies must to create demand for our products. What nonsense. Pushing products into a distribution channel is like pushing on a rope. Distribution is an asset only if the product is pulled out the other end; if customers are brought to the reseller seeking the products for sale there. The responsibility for creating that demand rests primarily with the manufacturer; after all, it is he who keeps the majority of the money from the sale. Manufacturers who neglect this simple, eternal truth of retailing may, in the short term, post better profits but before long will suffer, along with their resellers, the symptoms of declining sales, falling earnings, and eroding market share.

How often do you see an advertisement from Autodesk in the publications you read? Compared to 1984 and 1985, how frequently do you see articles in the press about the myriad applications of Autodesk's products? Compare the visibility of AutoCAD, for example, to that of a typical Microsoft product such as Word or Excel. Immediately somebody shouts, “But those are mass-market products, not highly specialised products like AutoCAD. Besides, they're addressing a much more lucrative market.” Well, let's see. Microsoft's sales are about five times ours. Of that, about half is application software, so all the Microsoft applications, including Word, Excel, PowerPoint, Project, and Works, add up to about 2.5 times our sales. If you assume Word and Excel account for the lion's share of this revenue, that means the sales of these products are roughly comparable to Autodesk's revenue from sales of AutoCAD. So in fact the larger volume of these products is just about balanced by their lower retail price, yielding the same revenue. Word and Excel ads are everywhere. Where are the AutoCAD ads?

“You can't sell a product like AutoCAD the way you sell a spreadsheet. It's a different market, and it has to be addressed in a different way.” This claim might be credible if, years ago, people hadn't insisted you couldn't sell spreadsheets the way Microsoft sells spreadsheets. Remember when spreadsheets were vertical market tools for financial analysts in the Fortune 500? It was only after the products were mass marketed, widely available, and affordable that the market for spreadsheets exploded, including today scientists, engineers, high school students, and diet book authors. It was this same kind of expansion of the market for CAD, set into motion by Autodesk's early and highly successful though meagerly-funded communication efforts, that redefined CAD as something suitable for “anybody who draws.”

“But advertising is expensive! There are more cost effective ways to getting the job done.” Surely. And advertising and other paid promotion should be but components of a balanced program including trade shows, co-promotions, dealer incentives, and all the myriad ways market-savvy companies stimulate demand. If Autodesk were achieving high visibility in these other ways, one might conclude that advertising was unnecessary. But we aren't. In fact, I believe Autodesk is increasingly slipping from sight, except within the existing community that uses its products. Talking to them is important, but it won't expand the market; we're preaching to the choir. To build markets you have to go out, make some mistakes, find what works, then build upon it. And that costs money. Once you realise that the revenue from a major Microsoft application is comparable to the sales of AutoCAD, the invisibility of AutoCAD is even more inexplicable since Microsoft's margins are the same as Autodesk's. Microsoft isn't doing all that aggressive marketing by spending more on a percentage basis. They're either doing less of the things that don't get them in front of the customers, or they're getting more for their money.

Advertising is, of course, the last resort of the communicator. Autodesk was able to promote AutoCAD in the early days with very little direct advertising by gaining editorial coverage in a wide variety of publications. A five or six page story about a user's success with AutoCAD delivers many times the impact of an advertisement at a fraction of the cost. These days, however, AutoCAD applications have become far more common and more imagination is needed to get the attention of the press. Imagination is something that's never been in short supply around Autodesk, yet we seem to consistently squander the visibility it gains us through lack of follow-through. One of the reasons I started the cyberspace project was to create a high-profile, exciting technology project to make the company stand out in the industry. Well, at least that part worked! Within a year, Autodesk was mentioned in the technology focus column and later on the front page of the Wall Street Journal, in the New York Times, and in many other extremely hard-to-crack publications in which paid advertising is forbiddingly expensive. And did we effectively communicate to any of these writers, given the entré created by the cyberspace project, the Autodesk story, of how this project indicated our ongoing commitment to lead the three dimensional design market from the cutting edge? Well, no we didn't. That story, and with it the equivalent of several million dollars of paid publicity simply slipped through our hands. Or consider the month when Scientific American ran a screen shot from one of our products on the table of contents page and devoted two pages to one of our new products. Did we use that opportunity, in the same publication where Autodesk ran its first ambitious four-colour advertisement, to showcase the company and its mainstream products? No, we were identified by the columnist as a “California computer games company.” This would never have happened in 1984.

Foregone opportunities don't show up on the profit and loss statement, at least not right away, nor are they ever itemised and charged back to internal departments. But each one is the equivalent of burning current dollars and bypassing future opportunities.

If AutoCAD's invisibility is not in keeping with its importance, then the consistent lack of support for new products makes their failure inevitable. We spend large sums developing a product, ship it, ignore it, and it fails. After a while, nobody's interested in promoting new products because “they all fail.” And eventually, so does the company. Ignore the subtler points of strategy and look only at the numbers. Autodesk is committed to increasing its sales and earnings at a rapid pace for the foreseeable future. The price/earnings premium on our stock reflects an assumption we will succeed in this. Since AutoCAD already commands a large share of the current CAD market, we cannot achieve this growth by taking business away from competitors. Consequently, the growth objectives can be met only by broadening the market for AutoCAD, thereby increasing its sales, or by launching new products which, in time, will contribute revenue and earnings comparable to AutoCAD. But if we don't promote AutoCAD, how is its market to grow? And if we push each successive new product off the loading dock, keening our ears for the thud that indicates “another Autodesk new product flop,” how are these products to help us? The absence of effective promotion of either AutoCAD or our new products precludes success through either path.

“Sure, we'd like to do all those things, if only we could afford them, but the money just isn't there in the budget to do the kind of advertising, promotion, and public relations you're suggesting.”

Out of two hundred million dollars a year?