|

|

Information Letter 3 was the first to delve into the gory details of how the company was to be organised, capitalised, and run. Dan Drake wrote this information letter after consultations with Robert Tufts, a San Francisco lawyer to whom we were introduced by Jack Stuppin.

The Organization Plan which is included with this mailing is the proposed plain English version of our plans. On Sunday we hope to reach agreement on the real thing, which we'll get written up by legal counsel. If we don't run into any snags at that point, we'll go ahead with forming the corporation.

At this point I ought stress that I am not now, nor have I ever been, professionally qualified to give financial or legal advice; I don't think that there are substantial errors of fact or law in this paper, but there may be.

Though this is a corporation rather than the limited partnership that we favored at first, the organization plan in general is very close to what we talked about on January 30 and what people expressed in their letters. There has been a change in the plans for getting computers, but the change should have little practical effect.

The company is going to be organized as a privately held California corporation. In effect, the government wants us to be a corporation, and there is not enough reason to buck it.

The argument against a general partnership, in brief, is that any general partner can commit all the assets of the company. Furthermore, the general partners have to stand behind the company's commitments not only with their shares of the partnership, but with everything they own. The partnership agreement may name some managing partners who are the only ones authorized to act for the company, but the company could still be bound by unauthorized actions!

A limited partnership is hardly better. The law is not absolutely clear, but it is likely that limited partners who took any active part in the business would be declared general partners as soon as any litigation started, which reduces this to the previous case.

So a corporation it is. Here's a really crude outline of the procedure:

After registering the corporation with the state, the people who are doing the grungework appoint themselves as the Board of Directors and do assorted necessary paperwork. Part of this paperwork is a plan for the issuance of stock.

Then we hold a grand meeting at which we issue shares of stock in return for cash, notes, and other things. We immediately hold a stockholders' meeting to approve a stock option plan, and to elect a new Board if we want to. At that point we're officially in business.

The shares will be common voting stock, representing a fractional interest in the company, just like General Motors stock (though with a few little differences):

The basic arrangement for the first issue of stock is rather simpler than the things we talked about in January.

You'll notice that we have written everyone down for some amount of stock in the Organization Plan. Don't be upset if you don't recognize the numbers opposite your name; we had to make some kind of guess, and this doesn't represent a commitment, expectation, or anything else.

We expect to issue some additional shares for other considerations. Among these will be the rights to Interact and the expenses that MSL incurs during the formation of the company. We may also sell small blocks of stock for cash to non-employees closely associated with the founding of the company, such as legal and financial experts.

Shortly before the stock is issued, we need to know exactly how much each person is taking, and on which basis.

The plan is now for the company to buy whatever equipment it needs out of its own funds. If you already have equipment, you can sell it to the company, or you can go on using it instead of using a company machine. This gives the company control over the choice and allocation of equipment, and lets people invest as much as possible directly in stock. The disadvantage of this arrangement is that the tax breaks are less attractive, but tax breaks are only one consideration out of many.

Out of the cash that we get for issuing stock we'll pay for equipment and the costs of setting up the corporation. This will leave us with enough money in the treasury to pay the very small expenses of the first few months, when we have no costs for salaries, rent, or advertising.

Once we have products to sell, we'll need much more money to carry us until we start getting enough income to cover current expenses. The number we've talked about is a total of $100,000 beyond the initial equipment purchases. To raise the money we expect to sell more stock during the first 12–18 months of operation.

The specific plan is to issue warrants along with the first issue of stock. A warrant does not convey any ownership share in the company, but entitles the holder to buy another share at a set price, namely $1.00. If it isn't exercised within a fixed time, it turns into wallpaper. It can be bought and sold on the same basis as stock.

The people who are expected to come up with additional financing (currently Marinchip Systems Ltd. and John Walker) will be issued warrants. In addition, everyone who is buying stock for cash will actually get a “unit” consisting of one share and one warrant, for $1.01; this is the extra goody, mentioned earlier, to encourage people to provide the company with cash. The warrants will probably expire in 18 months.

One of the essential ideas of the company is a sweat equity plan by which people get an ownership interest in lieu of salary during the startup. Stock option plans are now a very attractive way of handling this.

Basically, the company issues options which can be exercised in the future at a fixed price. To qualify for tax breaks, this price will be 110% of the fair market value when the options are issued. What we hope is that the stock will become extremely valuable so that you can exercise your option at the cheap price, sell for a high price, and pay capital gains tax on the difference (plus straight income tax on the option price).

The tax laws force a few conditions on the price and expiration period of the options, but these should not be troublesome. Within these conditions we have a great deal of freedom in specifying the terms of the options. We'll circulate more detailed information on qualified stock option plans later, when we've consulted officially with the experts.

The Organization Plan includes an outline of a stock option plan. We ought to get a pretty firm agreement on details during the Sunday meeting, since this is such an important part of the whole plan.

Unpleasant question: What if someone does no work at all? In the extreme case he can be fired, forfeiting any options he has, but retaining any stock. In lesser cases he gets a severely truncated option.

Next unpleasant question: How is it determined who has been working enough? This has to be subjective; it can't be a matter of lines of code generated, divided by bug reports. The subjective judgement should follow easily from the experience of answering the phone and telling customers which products aren't ready yet. Inevitable differences in productivity are handled by bonuses for brilliant work and by not having duds among the founders.

One thing that scared us when we considered incorporating was the personal holding company rule, which can impose a 70% penalty tax on a corporation that makes too much of its money from royalties or other passive income. It turns out that there's a nice, clean exemption, designed for the use of movie and TV production companies, whose business is really very similar to the software business.

The rule is something like this: if half your income is from the

sale of copyrighted material, and you spend 15% on expenses

other than salaries, you're not a personal holding company. Our

material will certainly be copyrighted, and we'll have no trouble

spending 15% on advertising, so we seem to be home

free.![]()

There are potentially serious problems from a person's present employer claiming ownership of anything the person does for the new venture. If you have signed any agreement on ownership of patent rights, etc., please get us a copy of it.

Even if you haven't signed an agreement, you have certain responsibilities to your present employer, if any. We'll have to have legal counsel draw up a paper by which everyone will make clear his right to create software for the venture.

To strengthen the business end of this business we've enticed Jack Stuppin to join us. Jack has several years experience in running a company that manufactured mass-marketed products. He has even more experience in finance, including some startups of companies in the silicon business.

We also seem to have found an accountant and a lawyer for the company, both first-rate. The lawyer, Bob Tufts, has worked with Jack on high-tech business startups and has expressed interest in making a small investment in MSP.

The Computer Faire brochure for “Cardfile”, which had by then been renamed “Autodesk”, marked the first public appearance of what eventually became the name of the company. At the time, however, we were still calling the company Desktop Solutions.

Speaking of MSP, the need for a name for this company has become critical! We also need names for the things that we're now calling Interact and Cardfile. It would be really nice if we could latch onto a neat little prefix, like Visi-, to distinguish our products. Please, please come to Sunday's meeting with a list of all the names you can think of, no matter how silly.

In the meantime, we'll probably have to print brochures for the

Computer Faire, using Marinchip's logo and arbitrary names for the

products.![]()

In addition to employees' agreements, we need some more information from everybody.

First, after studying the organization plan, please indicate as specifically as you can what your financial and working participation will be. The numbers in the plan are based on the first letters that people sent, but the figures in those letters were sometimes vague, and the rules have changed to some extent.

We also need your phone number and the name and address that you want entered in the company records.

And the resume. Don't bother with a fancy one, suitable for impressing employers, but give a good summary of your technical background. If we want to impress IBM with our qualifications, we'll re-write the resumes in a uniform style.

The next meeting is on Sunday, March 7, at 12 Noon. It will be at Jack Stuppin's house in San Francisco.

Does anyone have a good cassette recorder for recording this meeting? I'll bring a cheapo, but if you have anything decent, please call John at 383-1545 to volunteer as a recording engineer. We also need to make copies of the recording so that we can send them to several widely scattered people.

This plan covers the initial issue of stock and warrants by MSP (the code name for the new venture). The purpose is to raise money for equipment purchases plus working capital for the first 12–18 months. The plan includes allowance for a qualified stock option plan.

Most of the numbers have been filled in, at least to a good approximation. Uncertainties are due to continuing negotiations and to the rough figures given in the participants' letters of intent.

Throughout the plan it is assumed that this will be a private

offering, limited to the group named in the table of participants

in a later section.

The company will issue approximately 100,000 shares of common stock out of an authorized total of at least 350,000. It will also issue approximately 100,000 warrants, expiring in 18 months, which can be exercised to buy common stock.

Stock will be issued in return for cash, computing equipment, notes, and other considerations at a price of $1.00 a share. Warrants will be issued at $.01 each.

Investors putting up cash will pay $1.01 for a unit consisting of one share of common stock and one warrant.

Those having computing equipment needed by the company will be able to sell it at a negotiated price representing fair market value, in return for common stock at $1.00 a share.

Each participant will be able to buy up to 3,000 shares on a 10% note payable in three years. The note is to be a recourse loan, representing a potential claim on any of the investor's assets.

Each participant is expected to invest in at least 3,000 shares by means of cash, equipment, or notes. The investment may be through a partnership or a corporation, though a corporation may not issue notes for shares.

It is expected that stock will be issued to Mike Riddle in return for the non-9900 rights to the Interact package, contingent on delivery of a working version for certain computers within a fixed time. Stock will also be issued to the founding group, Marinchip Systems Ltd. (MSL) in return for expenses incurred in organizing the new company and possibly for software, including QBASIC.

All or nearly all of the participants will be employed by the company at a nominal salary of $1.00 a year. In lieu of proper salary they are to receive stock options.

The first stockholders' meeting will adopt a qualified stock option plan covering all the participants who are employed by the company when it begins operations. There should be agreement in principle on this plan, including the quantities involved, before the corporation is organized. Here is a suggested outline:

150,000 (?) shares of the stock of this company (equal to 1.5 times the original issue of stock excluding warrants) are set aside for the company stock option plan, with options to be issued in equal quantities at the end of 6, 12, and 18 months after the company begins operation.

Each of the initial employees of the corporation will make a commitment to perform a specific amount of work per week for the corporation and will, having performed that work diligently, be entitled to options in proportion to that commitment. Smaller allocations, not necessarily in proportion to work performed, may be given to those who have not fully met the commitment.

In each distribution 60–75% of the options will be allocated according to work committed and performed, as described above. The remaining options will be awarded as bonuses for exceptional performance. The percentage allocated to bonuses need not be the same in all three distributions.

The Board of Directors will appoint a three-member Compensation Committee to determine the distribution of options. The Committee's plan will be submitted for approval of the Board, which may submit it to the stockholders. The resolution of the Board of Directors will set an option price which will be 100% to 110% of the current fair market value of the stock. Options will be valid for five years from the time of issuance, but will in any case expire upon termination of employment.

Out of the cash received for the first stock issue the company will buy about $25,000–30,000 of equipment and pay any remaining costs of organization. During the first 90 days of operation other expenses should be nominal, limited to telephone costs, printing of letterheads, and such.

When products start to be available for sale, there will be expenses for sales and production. Until revenues match operating expenses, the company expects to raise operating capital by the participants' exercise of warrants.

In order to get the rights to Interact, the company expects to enter into a royalty agreement with Owens Associates, which underwrote some of the development of the package. The details of this agreement have not been worked out.

As most of the participants are now employed in the computer industry, there is a possibility of conflicting claims to the rights to software written for MSP. All participants will be required to certify that they have the right to develop software for the company, clear of any claims by any other employer.

No other liabilities are known.

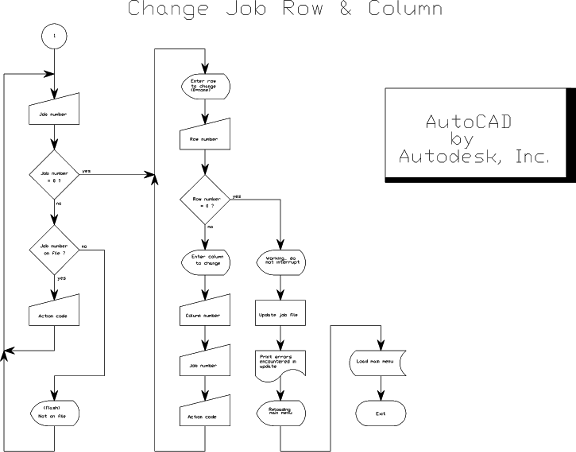

This drawing was originally done on AutoCAD-80 shortly before COMDEX 1982 as a show demo. The program described by this flowchart is one of the Marinchip business application packages.

|

|