|

|

Ever since AutoCAD began to include 3D and other facilities oriented more toward model building than production drafting, there had been an ongoing low-level controversy over how Autodesk should proceed in broadening its coverage of the CAD/CAM market: develop new products with links to AutoCAD, or simply grow AutoCAD into an integrated tool which encompassed high-end modeling as well as drafting and detailing?

This paper, written in early 1990 by then-V.P. of Technology Ron McElhaney, describes the CAD/CAM market, AutoCAD's place within it, the difference beween Autodesk and the traditional high-end vendors, and the opportunities in the newly emerging field of Mechanical Design Automation. Ron suggests a course of action to allow Autodesk to position a new product in this domain just as AutoCAD had succeeded in the drafting sector.

by Ron McElhaney

March 15, 1990

AutoCAD has a leadership position in the desktop CAD software market. The reasons for this are many, but include the fact that Autodesk sells useful products to a customer base whose needs it fully understands, and with whom it has built a deep and lasting relationship. We are now beginning to see increased competition from the “high-end” turnkey vendors. In fact, we are now seeing them begin to adopt some of our own successful business practices. The use of dealers, the stress of open architecture, and the encouragement of third-party developers are serious competitive responses which should convince us that these vendors understand the importance of beating us in the open market. What must Autodesk do to guarantee that it will be Autodesk which survives the inevitable high-speed collision, and not Intergraph or Prime? More importantly, if we succeed in displacing companies such as Intergraph, will we do it at the cost of estranging those very customers who have been responsible for our great success?

The battle lines in the war for CAD dominance are just beginning to form Initially almost unnoticed in its rapid rise to success by the “high-end” vendors, Autodesk is just now beginning to skirmish with full-function, turnkey-vendors such as Intergraph. Short-sightedness (or more properly, blinding stupidity) on the part of Intergraph management has led them to believe that we have been isolated in the “low-end” category of CAD/CAM, and to design an attack on us there.

The guns they are bringing to bear on us are aboard their MicroStation product, their desktop solution which they offer in direct competition to AutoCAD, while their flagship product aims its cannons at more `sophisticated” competition.

What Intergraph fails to realize, of course, is that by combining more and more functionality with greater and greater openness and adaptability, we at Autodesk will soon have the ability to create whatever we need to provide the customer useful products at all levels, from high to low and everything in between, eventually to include a battleship that will blow them out of the water.

The thought of breaking through the barricades, confronting the enemy on his own ground and defeating him with superior weapons is almost poetic in its justice and simplicity.

The opening argument has all the right elements for being the call-to-arms for Autodesk development. It is aggressive, suggesting at a violent confrontation with our competitors on the high end, with a victory for Autodesk guaranteed after the battle is done. It discredits their way of life and promises a drastic, but deserved, fate for the turnkey vendors, a result consistent historically with what Autodesk has done to its competition in desktop CAD.

Not surprisingly, this argument seems to be accepted within Autodesk almost without argument, representing, in some sense, the default position concerning the future of AutoCAD in the CAD/CAM industry. It takes for granted that the only differences between the turnkey world and the world of desktop CAD are technological. It assumes that as more and more power accrues to the user of desktop CAD, and as we at Autodesk begin to add more and more technology to our system, the differences between turnkey CAD and desktop CAD, both perceived and real, will diminish, resulting in desktop systems offering essentially everything which the turnkey vendors can, but doing it in a more cost-effective way.

A simple-minded extrapolation of AutoCAD, based on our continually increasing its technical content, appears to cause it, at some point in the not-too-distant future, to be positioned directly against the high-end vendors. This simple extrapolation hints that history may repeat itself, causing a future AutoCAD, chock full of powerful technology, to become the product of choice for all CAD users, as they leave the turnkey vendors en masse for a cheaper, better solution.

This argument is exactly what investment analysts and industry consultants want to hear. It promises increasing market share, continued quarterly dividends, greater and greater margins, and an earnings per share which increase off the charts. It is music to their ears, and they react in predictable ways, helping to send our stock higher and higher. That's where the real action is, at the high end of CAD/CAM, isn't it? Is it?

There are several serious problems with this simplistic view of AutoCAD's future. First, although the most obvious differences between the desktop vendors and the turnkey vendors are technological, the most significant differences have very little to do with technical content. The most important differences have to do with basic philosophical issues.

AutoCAD is undeniably the most popular CAD product in the world. We all know the impressive numbers: several hundred thousand licensed users, and many times that in illegal copies make AutoCAD the practical standard in desktop CAD everywhere CAD is done.

How has Autodesk managed to be so successful? We can all count the ways, but when we do, we find that providing superior technology is not one of them. In retrospect, Autodesk succeeds because it is a superior business.

Dedication to the customer and serving their needs has turned out to be more important than providing leading-edge technology. That attitude of presenting a strong, almost fanatical dedication to the user is apparent in everything we do, and is recognized by the user who rewarded us in spades.

The “bulking up” of AutoCAD may not guarantee us any greater success than we now have. it may, in fact, achieve exactly the opposite, especially if high-end features are arbitrarily added to the system without regard to the benefits which they bring. It is clear that much of the current customer base of AutoCAD has little need for many of the advanced features which we are contemplating adding to future versions of AutoCAD.

As we add NURBS-based solids modelers, constraint management systems, and other “sophisticated” features, we should ask ourselves what our users, who have purchased AutoCAD for years to do their drafting/drawing work, will do with these fancy features, Will these users see each additional release of the product promising them only unneeded features and increasing complexity? If the added value is not perceived to be great enough, the simplest decision users can make is to buy a system which better serves their needs.

The potential effect on our business would not be confined solely to those users which were left behind in our “dust” as we climb the technology curve. By orienting our marketing to the customer base which does have a need for these features, we will be forced to position ourselves in a market with which we have a small collective experience, and where our ability to succeed is untested. Can we risk the abandonment of a large number of loyal customers who have helped us to achieve our current enviable position of market domination and financial success?

I do not believe that one product can span the range from desktop CAD through high-end CAD, and that for AutoCAD to continue its world-beating success path, it must continue to provide solutions which are consistent with our current users' requirements and with our own experience. I feel strongly that adding technology which will not contribute to making AutoCAD a better and better drafting and drawing system would be a serious, perhaps fatal, mistake. This must continue to be the most important goal of the company.

At the same time, we cannot ignore other technologies such as solids modeling and parametric design. A large amount of money is spent each year on `high-end” technology. As I will discuss later, most of this is spent by large companies in the process of making high-level, corporate-wide strategic decisions, decisions which have very little to do with practical, day-to-day efforts, but with systems and technology which, it is believed, will affect the company's future, and its ability to compete.

I believe that a real opportunity exists in the area of what is being called “design automation.” It is here that the next attack on the turnkey vendors will take place and, with Autodesk's participation, this attack may be fatal. The last large attack was, of course, mounted by companies such as Autodesk, which drew large numbers of users away from the turnkey vendors, and which left them whole, but broken.

Within the vanguard of the movement toward design automation were companies such as Cognition and Aries who, like many companies first on the scene, could not see the future clearly enough to compete successfully against the turnkey vendors. The second wave is represented by companies such as Parametric Technologies Corporation and Ashlar Vellum, and many others sure to follow. These products now offer clever and innovative approaches to design, and will surely contribute toward changing the methods of design engineering in much the same way that the Macintosh changed the way we interact with computers.

Autodesk should be in this fight for dominance in the engineering design market. The most important reason is that this market provides us with an opportunity to take advantage of the weakness and stupidity of our high-end competition; and gives us a real chance to take a run at leadership of the traditional CAD/CAM/CAE market by offering a useful, well-crafted, competitive system at the so-called “high-end” of design. This should not be difficult for us to do and the probability of success, in some significant form, seems to be almost certain.

Secondly, we have all the technology necessary to be competitive in this market, plus an advantage shared by no one else: an awesome presence in the CAD/CAM industry throughout the world, and a loyal following which is ready-made to extend our mastery from drafting/drawing to engineering design.

It will not simply be a matter of technology which will determine our success here. It is my view that the two industries of desktop CAD and turnkey CAD/CAM/CAE are vastly different, one from the other, and a strategy of success in one market will not guarantee similar success in the other. Not only are the companies which provide product for these two markets themselves different, but the motivation which drives them to develop features for their customers is also different. In fact, the users of each type of system themselves share few similarities, especially in what they expect from their systems.

For this reason, and many others, I do not believe that we can be successful attempting to cover the broad market, providing solutions for “low-end” drafting and drawing, and high-end design and integration with one product, and that a successful strategy will require covering the market with different products.

This strategy would have us create two products. One of them would remain AutoCAD, allowing us to continue our self-evident path of success in the area of drafting and drawing production at which we are the world's most successful.

The second product, based upon AutoCAD, could be aimed, easily and almost without effort, toward filling a vacuum at the high-end, left by the short-sighted, old-fashioned, and bankrupt practices of the turnkey vendors. Such a product might be called “AutoCAD Designer.”

Containing competitive technology, and focused on solving important problems in the design segment of the manufacturing process, as AutoCAD was focused on the drafting/drawing process, the Designer would provide Autodesk with the ability to make significant inroads into a customer community which has traditionally been all turnkey-based.

If we were to achieve success here, there would be few places left for these dinosaurs to hide and a drastic “re-adjustment” should occur in the high-end vendor community within a few years as the very foundation of their business begins to disappear. Almost as significantly, we would be able to short-circuit the success of companies such as Parametric Technologies Corporation (PTC), whose customers would find it an easy decision to transfer their loyalty, and their money, to a company which is becoming an institution in the CAD/CAM market.

I mentioned before that these two industries are different. In fact, I believe that they are, in the final analysis, more different than they are similar. An understanding of these differences will lead to a deeper appreciation of what approach we should take to displacing the turnkey vendors. In the following few pages, I will provide an in-depth discussion of the world of high-end CAD/CAM. My purpose is not to honor it, but to show how different are the fundamental factors which influence it, both from within the turnkey companies themselves, and the companies and individuals which buy and use

When l refer to “desktop CAD,” I am of course referring to products such as AutoCAD; products which were first offered on desktop machines, and which gradually evolved into what they have become today. I am not referring to transplanted technology.

By turnkey CAD, I refer to products variously termed “high-end” or “full-function” CAD/CAM/CAE/CIM/… products which contain a wide range of applications bundled within them, often packaged with a workstation and priced as a single unit. These are generally still big ticket items, and the companies which produce them are limited in their business outlook by the “traditional” view of CAD/CAM.

CAD/CAM as a sophisticated industry actually got its start within large industries which had the most to gain from automating the design and manufacturing process. Historically, these large companies, especially those within the aerospace and automotive industries, have been responsible for some of the most significant advances in the art and practice of CAD/CAM.

In the late 1960's and early 1970's entrepreneurs began to create companies which were based upon this emerging technology, many of them still in existence in 1990. The turnkey industry is, of course, much older than the desktop CAD industry, but it is also much older than the entire PC software industry. For example, Calma began business in 1968, Computervision, Applicon and Intergraph (as M&S Computing) in 1969.

During that period of more than twenty years, the turnkey vendors have managed to develop some very useful applications based upon sophisticated software components, and have changed hardware platforms (and even languages) many times. By the time desktop CAD appeared on the scene in the early 1980's, the turnkey vendors had already invested thousands and thousands of man-years in the development of their systems and had solved most of the basic problems associated with design, drafting, analysis, and manufacturing.

Although the companies representing the turnkey CAD/CAM industry are not doing particularly well lately, they have as a group introduced a generation of engineers and designers to the use of computer-assisted techniques, and in their efforts laid the foundation for the eventual success of desktop CAD.

One of the areas in which the turnkey vendors have made significant progress, far beyond the ability of most manufacturing companies to keep up through internal development, is in their ability to represent and manipulate “difficult” geometry. It is in this area that the level of technology between early desktop CAD and turnkey CAD differed the most. Whereas desktop CAD provided lines, arcs, circles, and occasionally splines and conic sections, the turnkey systems offered a fully parametric wireframe and surface modeling capability attempting to support sophisticated mechanical applications such as 3- and 5-axis N/C. This difference in modeling representation is only now beginning to change as the desktop vendors begin to climb the technology curve.

What caused the rapid success of desktop CAD, and why didn't the turnkey vendors themselves benefit by the revolution which was plainly occurring? Why wasn't Computervision or Calma, for example, the first one to offer CAD on a desktop? Why did the success of desktop CAD await the founding of companies such as Autodesk?

Although these questions are fundamental, the answers to them have more to do with self-image and perceived destiny, than with business.

To begin to understand how truly different Autodesk is from the turnkey companies, consider how these high-end vendors view themselves.

One of the reasons that Autodesk was ignored by the turnkey vendors in the early days of desktop CAD was that the developers of the high-end systems honestly discounted any value which desktop CAD systems would be able to offer to users. The concept of “CAD-on-a-PC” directly conflicted with their understanding of their own essential purpose in life, which was to bring order, power, and complete integration to the design and manufacturing process.

A CAD/CAM veteran at that time would have described his system as something to design with. “Sure,” he might have said, “our customers use our system to do production drafting, but its true value derives from the fact that these users can create a complete digital representation of their models, and all the integrated applications which we offer can access this model directly, taking whatever application-specific data it needs. Thus there need be only one copy of the data for everyone.” He would have smiled smugly at this point.

“FEM users can access the original model, subjecting it to analysis, re-design, and successive refinement. Stylists can obtain photorealistic visual output directly off the model, toolpaths can be created automatically which will drive machine tools, and draftsman can produce drawings by working directly with the model.

“Drawings are a by-product of the process,” he would have said, his nose wrinkling slightly. “Not an end product by itself.

“Who would ever want a drawing as the only output of a design process?” the CAD/CAM veteran would continue, his voice undoubtedly rising in pitch and volume. I mean, who else could use it? How would you get the data from one application to another without having to re-input it?” At this, he would probably shiver as if he had glimpsed a world he didn't want to be part of.

It was crystal clear, at least in the minds of these CAD/CAM veterans, that any user worth his salt would choose the turnkey system for his work, and only those who couldn't afford the high ticket prices would be forced to settle for the poor imitations of CAD systems offered by the PC software vendors.

For “poor imitations” is exactly what the turnkey vendors believed them to be. These sophisticated, dedicated, and right-thinking representatives of high-end CAD/CAM, collectively looked at the desktop CAD systems and could see no justification for their use, as hard as they tried to see it. Because of this, they completely ignored that piece of the market and allowed upstart companies such as Autodesk to not only grow, but in their success to grab large numbers of their customers, and to never give them back.

Consider the standard, instinctive and universal reaction by members of the turnkey CAD/CAM community to the success of Autodesk. The party line, which was actually deeply and honestly believed, was that AutoCAD was being purchased simply because it was cheap, and that after companies bought it, they put it away and never used it again. This was a popular theme at all of these companies, at every level from consultant to programmer, from salesman to Chairman of the Board. By this reasoning, the failure of Autodesk was only a matter of time as users eventually, but inevitably, came to their senses and returned to the family.

But let's briefly look at the real history of desktop CAD. Consider what a customer got for his money when he bought a turnkey system in the early 1980's. For $100,000 a seat, this customer could design, analyze, refine, view, dimension, and manufacture his parts. The goal has always been to achieve all of this from one single data representation, but this was never achieved. The process wasn't perfect, or even close to perfect as all users knew, but it essentially worked. Compared to old-fashioned, non-interactive or manual methods, it represented a true revolution for that user.

Consider the user of the desktop system of the early 1980's. For $10,000 a seat, the customer could create very complicated engineering drawings, and easily output them to paper, but that was all. Did the desktop system attempt to solve all of the customer's problems, or to provide a total solution? Not hardly! Did you get more for your money from a turnkey system than from a desktop system? Clearly!

Why then would any user be satisfied with a desktop system? How could any company settle for less than a full-solution approach? Shouldn't this be the goal of all users?

Well, there were a few small problems with this view of CAD/CAM users.

First, while this top-down, highly elegant and abstract way of looking at design and manufacturing is pleasing to the intellect, and certainly reflected the majority view of upper management of the Fortune 500, it unfortunately had virtually nothing to do with CAD/CAM as it was practiced by the majority of users in 1982.

Keep in mind that, even today, out of approximately 2,200,000 machine tools in existence in the United States, less than 10% of them have a computer attached to them. Computer-controlled machine tools need digital input, but all those others having human operators demand analog input. Typically, the source of this input is from light waves bouncing off a multi-view drawing into a machine-tool operator's eyeballs, and then passing directly into his brain. More often than not, this drawing will have been produced on a desktop CAD system.

Secondly, most parts in this world are designed and manufactured by small shops. You would be amazed to know how little of a General Motors automobile is actually produced directly by General Motors; most is produced under contract to small businesses.

As soon as professional drafting capability became available on PC's, the reaction of users was immediate; they went out and bought it in droves. As a result, the market began to be differentiated, and users with different requirements began to express themselves by buying different types of systems.

At the “low” end, where small, production-oriented companies tend to exist, desktop CAD was an instant success. Generally, these small businesses produce their products according to their own techniques and can't afford, don't want and don't need some gigantic, complicated, totally integrated, corporate-wide unambiguous model representation, when all they need is to produce a drawing, thank you very much.

At the “high” end, large companies bought large systems top-heavy with features. Where the practice of design and manufacturing allowed it, integrated techniques began to be utilized, and designers, draftsmen, and application engineers worked on the same system, all sharing the same database. For them, the turnkey approach was ideal.

Where integrated environments were not available within these large corporations “pockets” of traditional CAD activity continued to exist, and still exist today. These pockets existed in spite of corporate management, not because of them. It was here that desktop CAD found a home.

Within these large corporations, many users attempted to justify the purchase of the expensive turnkey systems on the basis of the enormous return the company would see in automating the production drafting process, but they rarely got a payback on the drafting alone. Before the advent of desktop CAD, many customers in fact found it cheaper, and just as efficient, to go back to pen and paper. With the availability of low-cost desktop CAD, thousands and thousands of users not only found that this was an attractive alternative to the turnkey vendors, but that it was exactly the right solution for their needs. They simply didn't require anything more.

The fact that the turnkey vendors should have seen this years ago is not only testament to their lack of vision but to their obvious ultimate, and totally inevitable fate. The fact that the desktop CAD vendors did see this (looking back, I'm not sure if this was through incredible foresight or simply a keen observation of what was happening, and then a reaction to the opportunity), is evidence that giving the customer what he really needs, and not just what you want to sell him, still counts for something.

In the face of overwhelming evidence, what is it about the turnkey vendors which cause them to believe in their own approach so strongly?

Keep in mind that the turnkey vendors saw themselves having a guiding purpose in life; a mission, really, which was to bring perfection to the design and manufacturing process. The achievement of one single, unambiguous and complete digital representation of real objects, so that a complete simulation of the manufacturing process could be performed, was thought to be within their grasp. The pursuit of anything less than this level of perfection was simply not worthy of their efforts.

Fortunately for us, Autodesk didn't labor under such a burden; making money, and providing useful solutions to satisfied customers seemed to be sufficient motivation.

Although it may no longer be true in two years, it is relatively safe to say that at this point in the evolution of commercial CAD, one can make a simple distinction between the desktop and the turnkey systems. Desktop systems are drafting systems, generally purchased by users whose needs are local, well-defined and practical, and whose requirement of that system is principally as an aid in the creation of drawings or other visual artifacts such as renderings. The turnkey systems, on the other hand, are intended by their creators to build complete digital representations of real-world objects. This is called a model.

It is important to understand that, even if levels of technology were even closer than they now are, this would continue to be a fundamental difference between the two. Take away the integrated applications of a turnkey system, and you would be left with a system whose purpose, at least from the point of view of those who produced it, was to provide high-level modeling capability, that functionality having been developed to address the most difficult problems of manufacturing companies, not merely to provide a basic design solution; and certainly not as a system for simply putting lines on paper.

Since the turnkey vendors believe themselves to be in the business of providing modeling capability to be accessed by the world of applications, they universally tend to regard drafting and drawing production as a necessary, but technically unchallenging, therefore unimportant, adjunct capability. I mean, anybody can create a drafting system, can't they? Where's the challenge in that?

The challenge was not technical, of course, but financial, and Autodesk saw this early. Its customers, who are much different from turnkey customers, made it successful and are continuing to do so.

Although it may no longer be true in two years, it is relatively safe to say that at this point in the evolution of commercial CAD, one can make a simple distinction between the desktop and the turnkey systems. Desktop systems are drafting systems, generally purchased by users whose needs are local, well-defined and practical, and whose requirement of that system is principally as an aid in the creation of drawings or other visual artifacts such as renderings. The turnkey systems, on the other hand, are intended by their creators to build complete digital representations of real-world objects. This is called a model.

It is important to understand that, even if levels of technology were even closer than they now are, this would continue to be a fundamental difference between the two. Take away the integrated applications of a turnkey system, and you would be left with a system whose purpose, at least from the point of view of those who produced it, was to provide high-level modeling capability, that functionality having been developed to address the most difficult problems of manufacturing companies, not merely to provide a basic design solution; and certainly not as a system for simply putting lines on paper.

Since the turnkey vendors believe themselves to be in the business of providing modeling capability to be accessed by the world of applications, they universally tend to regard drafting and drawing production as a necessary, but technically unchallenging, therefore unimportant, adjunct capability. I mean, anybody can create a drafting system, can't they? Where's the challenge in that?

The challenge was not technical, of course, but financial, and Autodesk saw this early. Its customers, who are much different from turnkey customers, made it successful and are continuing to do so.

Large companies typically spend many millions of dollars each year simply to determine general strategic directions for their companies in CAD/CAM/CAE. These companies typically identify individuals, or groups of individuals, who are vested with the great responsibility of charting that future course within the company. Representatives from Engineering, Manufacturing, Design and occasionally MIS regularly meet in long, intensive sessions about what will be the technological basis for the next generation of CAD/CAM.

What they are attempting to find, of course, is one single, grand solution for the company's CAD/CAM needs. The fact that this process has been going on essentially without change for the last twenty years in the American manufacturing industry is evidence of how important this is held to be.

The CAD/CAM selection committee is a creation of such thinking, and is responsible for the support of a generation of CAD/CAM consultants who continue to recommend variations on the traditional theme to these corporate users. The actual product which is the result of the consultant's analysis or selection committee's conclusion varies with the consultant's background, the target company's needs, and the weather. But it is ultimately tied to a checklist of features which CAD/CAM selection committees assemble as the ultimate measure of a system's worth.

This feature list is common to those of you who have had some association, however brief, with a turnkey company. The presence of one of these features automatically activates a check mark next to that item on the list, and a tally of checkmarks is made at the end of the process. The majority of check marks does not automatically guarantee the selection of a particular turnkey system, however, since personal bias still plays a great part in the selection process.

See how the selection/purchase process for the turnkey system differs from the same decision for a user of desktop CAD. The purchase of an expensive turnkey system is a decision in which a large number of people have an influence. Generally, unless it is an addition to an existing pool of product, it must also pass the test of the CAD/CAM selection committee, be signed off by the head of the department from whose budget it will ultimately come, and very often by the President of that company.

In addition to being a major purchase due to its large price, the decision is of major import because it is part of the process of determining the strategic direction of that company for its entire future. People who buy drafting systems, even at the corporate level, do so based only on the utility of that system, not having to worry about justifying its strategic impact on the company's future.

This is one of the most important lessons to learn about the difference between turnkey CAD and desktop CAD. Desktop vendors are merely providing useful solutions, whereas turnkey vendors are providing future direction; they are dealing with strategic issues, not just practical ones.

One may disregard the importance of the criteria by which large companies buy CAD/CAM products only at one's own risk. This is actually how large companies spend their money. Drafting systems represent old and developed technology, and fail to cause any excitement in those who are charged with determining future strategy. Future directions must involve advanced technology, and the more advanced, the better. No one discusses drafting systems in the corporate boardrooms of Fortune 500 companies.

From one point of view, the goal of the turnkey CAD/CAM vendors (to totally automate, and totally integrate) is certainly worthy of our respect. Taken as a whole, the complete design/manufacturing process, which begins with a concept and ends with a manufactured part, is very complex. In any large company it requires literally thousands of separate steps from beginning to end, including the cooperation of hundred of individuals and tens of different departments.

The gain of even a small improvement in efficiency in any step of the process is absolutely guaranteed to result in a directly measurable increase in the profitability of that company, allowing it to better compete in its marketplace. This, plus the guarantee of an increase in quality of the finished product, is the ultimate promise of automation and is a siren's song that cannot be (and should not be) ignored.

The credit for revolutionizing the world's manufacturing industries must go to the turnkey vendors, of course, and not companies like Autodesk. We have made Autodesk one of the world's most successful businesses, and we affect the practical use of CAD on a scale which the turnkey vendors can still only dream about. But the credit for being there first belongs to them.

The widespread use of CAD/CAM in U.S. industry enabled it to remain competitive with nations such as Japan, which constantly threaten it with their ability to offer America's consumers cheap, but high quality finished products. Further progress is still possible, since the really difficult problems remain yet unsolved.

It is to totally automate and integrate the manufacturing process itself which the turnkey vendors have chosen as their goal. In the following paragraphs, we shall see what the scope of this really is, and begin to realize the scale of the problem which the turnkey vendors have set for themselves.

The totality of the design & manufacturing process is defined by implementation, and differs in detail within every manufacturing company. The following is representative of that process as viewed from within the turnkey industry.

Conceptual Design: Also sometimes called “preliminary design” or “functional design,” this stage deals not only with aesthetic issues such as styling, but with practical issues such as simulation and industrial design for manufacturability.

Paper and pencil, brush and oils, and sculptor's clay used to be the conceptual designer's tools in the automotive industry. Today, modern CAD/CAM systems provide him more and more powerful tools which free him from the necessity to create physical models.

It is here that companies such as Cognition, Aries, and Parametric Technologies have seen an opportunity to provide design engineers an entirely new way to approach the design engineering process; offering techniques which lie far beyond traditional methods and allow engineers much greater freedom to exercise their creativity.

Photorealistic rendering output is becoming an essential capability for conceptual design; it allows management to view the design as it would be manufactured, and also allows engineers to try different variations of the design without the accompanying investment in cost and time that normal prototyping techniques traditionally require.

Also loosely termed CAE, or simply “engineering,” various high-level capabilities come under this category.

Finite Element Modeling and Analysis is performed as part of the engineering process. This stage of the process, which is intended to subject a preliminary design to real-world constraints and to iterate on that design until its behavior, given the design, is acceptable. Even within the narrow discipline of FEM/FEA, there are many specialist disciplines. These include fatigue analysis, thermal, vibration and magnetic analysis. Plastics, iso-plastics, and composites complicate the analysis. The exercise of finite-element modeling and analysis is one of the more obvious “applications” to which an existing design is subjected, but there are a large number of others.

Interference analysis, structure design, mass properties, adherence to safety and/or corporate standards and imposition of local codes and regulations are often all requirements for a design to be accepted, and that design generally must pass these analyses before it can be considered for manufacturing or construction.

In the design of an automobile, for example, stress analysis is an issue only for key engine or body parts. More time-consuming is the ergonomic design of windshields, instrument panels, and even seats. A new water pump must not only be efficient, and deliver so much volume of water per minute, but it must also fit comfortably within the numerous other components which comprise an engine.

Also termed “design modeling,” this is another step in “reality design.” Often, a so-called “finished” design is impractical to manufacture. Setup costs, consistency with existing manufacturing methods, or excessive complexity may preclude the consideration of an otherwise good design, causing that design to be modified.

A large number of applications exist which satisfy this requirement. The lifetime of a stamping tool, for instance, can have a significant effect on the long-term profitability of a division which manufactures press parts: this requirement alone may have an overwhelming influence on its design. In the plastic injection process, many designs are instantly made infeasible due to their inability to lend themselves to the realistic flow properties of the liquid plastic that is injected into them at high temperatures and pressures. A difference in 5% in injection and cooling time for a complex mold can make the difference between profitability and loss to an industry which works with little room to spare.

Pedestrian considerations such as the design of clamps to hold parts while they are machined, and machine-to-fit tolerances given the practical availability of real machine tools are make-or-break decisions for a manager to make.

Included within this area are assembly verification, component design, and electro/mechanical design.

This is the world of AutoCAD, yet this area represents but a small part of the turnkey vendor's CAD/CAM universe.

Detail drafting represents no more than one-third of the requirement here. Technical illustration, schematics, and layout are equally important.

Before the days of geometrical models, detail drafting used to represent the “meat” of practical design. Due to the significant limitations of current turnkey design systems, much of detail drafting may never appear on a geometric model.

For example, fillets and chamfers may appear only as “features” on models and may never be represented as actual geometric constructs. As a practical issue, it is far easier to represent a fillet by a symbol on a drawing, and then to cut it with a single path of a ball-end mill, than to go through the difficult mathematics required to represent it geometrically. This is something which practical designers know and make use of.

Other aspects of the detail drafting process have to do with what we regard as “drawing creation,” and are intended to aid the ultimate downstream machining process. Surface finish characteristics, tolerance limits, detail magnification, and other aspects of detail drafting are not part of the geometrical model, yet become part of the total representation of the design by virtue of the fact that draftsmen, at least within the turnkey system, can access the original model and work directly upon a local representation of it, even though they are not allowed to modify it. Thus, draftsmen can be specialists in drafting and drawing creation, without having to be expert designers too.

Also termed “manufacturing engineering,” this phase of the process is one of the most complex and demanding. Composed equally of “manufacturing preparation” and “manufacturing simulation,” most companies spend the bulk of their CAD/CAM budget here.

Manufacturing preparation includes pattern nesting, tool design, fixture design, sheet metal development, manufacturing quality control analysis, and the actual NC programming itself.

Manufacturing simulation includes coordinate measuring machines, NC flame cutting, off-line robotics, NC tube bending, wire EDM, milling, drilling, routing, flame cutting, turning, and the important area of NC toolpath verification.

Although machining is essentially performed directly off the model geometry, it is by no means as “automatic” as the descriptions of it tend to imply. N/C is still more art than science, and even old-fashioned techniques of creating machined parts have not disappeared.

Creation of geometry is often the simplest aspect of the N/C process. Due to limitations in the algorithms which the turnkey vendors provide, “work-arounds” always have to be provided, including the ability of the user to directly edit the tool path which is being generated.

Toolpath simulation is intended to allow the user to see the form of the finished part that will come out of the machining process, and to correct any problems which are observed. The development and maintenance of postprocessors, which translate geometric toolpath descriptions into a language which each machine tool understands, is an industry in itself.

Modern turnkey vendors offer solutions for many of these areas, and generally more. Automatic nesting, sheet metal bending, plastic injection mold design, and mold flow analysis, shoe and dress design, and other applications are available within the turnkey vendors bag of tricks. It is their goal to provide the customer's total solution, and it is this which the turnkey vendors have been attempting, over the previous twenty years, to solve.

Have the turnkey vendors actually succeeded in the pursuit of this dream? Most users of turnkey systems would say that they haven't. The reasons for their ultimate failure have a lot to do with their history, and their strategy of operation.

Their systems are very large (huge, gigantic, and other descriptors don't really do them justice). Large systems, even if the original design was modern, open, modular, and easy to enhance conceptually, ultimately turn into monsters which are intractable, closed, and which reflect no individual's point of view.

Secondly, the turnkey systems offer just a few solutions to customers' problems, and these solutions are a product of internal development. This not only guarantees that these solutions must be “generic” in the sense that they must attempt to solve everyone's problems, but that they will similarly fail to please all who use them.

Finally, the philosophical approach to the engineering design process reflects thinking which was current when the system was originally created which, in most cases, was a long time ago. The sheer size of these systems makes it a practical impossibility to make significant changes to them. This is why smaller, more focused companies such as PTC are having “sudden” success and are beginning to gain the attention of the users of traditional CAD/CAM/CAE.

Far from providing a totally integrated and automated solution to the process of design and manufacturing, turnkey systems virtually require that each step in the process is separate from the other. This is what the new technologies are intended to address.

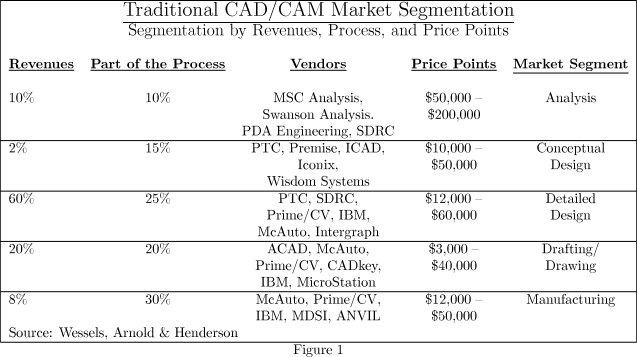

Figure 1 is a representation of the traditional CAD/CAM/CAE market. As one can see, it covers almost every aspect of the design/manufacturing process as we defined it previously. By the estimation of Wessels, Arnold & Henderson, an institutional research company, the mechanical CAD/CAM market “numbers over 2 million users worldwide and provides a total software revenue potential of $10–$20 billion at a 50% saturation expectation. We estimate the current penetration of the mechanical CAD audience is still less than 20%. More importantly, early users of CAD/CAM systems, using systems based initially on mainframes and minicomputers and later on desktop engineering workstations, are ready for a new level of design capability.”

These words were actually written to accompany an analysis of the potential for Parametric Technology's product, but they are as true for Autodesk as they are for PTC. In that analysis, the research company found that the most receptive customers to PTC's products were experienced CAD users who were frustrated with the disjointed process as actually provided by the turnkey vendors.

The failure of the turnkey vendors to provide integrated solutions to this process is shown by comparing the revenues obtained from a single part of the process versus the time manufacturing companies actually spend on it.

The conceptual design phase represents a relatively small source of revenue, but consumes more than 15% of the design/manufacturing process. According to a British Aerospace study, over 60% of the total money spent on a project is actually committed at the conceptual design stage, when very little is know about what the project will actually entail.

The traditional vendors have not sufficiently addressed this stage of the process, effectively causing the bulk of conceptual design being done with inadequate tools, including drafting and drawing systems.

As newer, more powerful, and more intuitive products become available, we should expect to see a rapid readjustment of spending to begin to match the commitment of actual resources, and the revenues arising from products which address the conceptual design phase should grow rapidly.

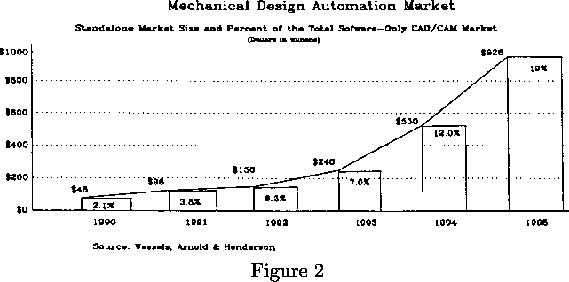

Wessels, Arnold & Henderson has studied a new market which they call the mechanical design automation market (MDA), and estimate that this market will grow well over 50% per year for the next six years, up from about $20 million in 1989 to well over $1.0 billion in 1995. They project that penetration of the entire CAD/CAM software-only market will then still be less than 20%. Figure 2 shows the prediction for growth of this market.

With respect to the drafting segment of the market, they also have a great deal to say, and it is worth quoting directly from their study.

“The Drafting segment of the mechanical CAD/CAM industry is characterized by several new participants, namely Autodesk, who have caused severe dislocation to the large turnkey CAD/CAM vendors who dominated the industry at the beginning of the 1980's. Autodesk, among others, entered the market offering slightly lower functionality for one-tenth the cost … compared to some drafting programs selling for well over $20,000 per seat….

“In the future, we estimate the drafting segment to continue to shrink as more of the process moves into the conceptual stage of development, causing further dislocation to the well-established vendors. Autodesk ought to be able to transition this move with its next generation of products and act as a catalyst for many users who want low-cost replacements for drafting and a strategy for the next several years to conceptual design (italics mine).”

What capabilities must a product have to be part of this projected explosion? The industry itself seems to have already defined the important elements of such a product. According to analysts, consultants, and CEO's of Fortune 100 companies, to even begin to address this requirement a system must include:

The modeling technology required here represents a litany of terms which most of us can recite flawlessly in our sleep. It includes Solids Modeling with NURBS, supporting non-manifold topologies. Feature-based modeling is also becoming an important weapon in this battle of buzz-words.

Another battle is being fought between those who favor the parametric approach (PTC) or the variational approach (SDRC). Having any sort of capability here, however, is becoming absolutely necessary even to play in the same field as these vendors. Based upon previous buzz-word wars I have seen, we should expect to see an industry-wide mad rush to place this capability, or something resembling it, on the feature list of every CAD/CAM product.

This is a much more difficult goal to achieve than the others because it doesn't depend so much on raw technology, as it does on applications such as FEM/FEA being integrated within the design process. What most systems lack is an interactive method to model, mesh, analyze, and re-model a mechanical part. This capability would provide those who offered it a great advantage in the market.

At Autodesk we have the ability to build such a product. Much of it could be in place for Release 12, and could be almost complete by Release 13. The philosophy of the Designer product would be that it would offer no options; every piece of advanced technology which we possessed would be part of the system. Additionally, it would contain no drafting or drawing creation capability.

This would allow it not only to leverage off existing AutoCAD installations as a high-end design station which would be 100% compatible with the AutoCAD systems, but AutoCAD could also leverage off the installations of the Designer product, especially within large corporations who have purchased Designer for “strategic” reasons. At a price of $5000, it could take a big bite out of PTC and Intergraph.

The Designer product must be compatible with AutoCAD, but not just through DXF files, or “translation” routines. To insure this, we must guarantee that the development streams share as much code as possible. In the long term, they should, in fact, be created off the same code base. By utilizing the fruits of the Proteus development, we will be able to provide and support different user interface styles for AutoCAD and Designer with very little extra effort. The databases should be identical as eventually should be the graphics pipelines.

The Designer must be consistent with AutoCAD in offering 3d-party developers with a rich array of tools, including external access to geometrical modeling, constraint management, and rendering capabilities of the system.

The user should be able to execute both AutoCAD and Designer within the same desktop environment, passing data (and geometry) back and forth in a manner transparent to the user. Additionally, selected “accredited” 3d-party applications should also share in this integration, giving the Autodesk customer the ability to create his own custom turnkey environment.

User interface tools, data access mechanisms, and style guidelines will be available to these developers, allowing them to create applications which are truly integrated with AutoCAD.

As an initial marketing strategy, we should probably identify a few key developers whose products would be “integrated” into the AutoCAD Designer, available as options from selected dealers.

The approach to modeling of AutoCAD Designer would allow several simultaneous points of view to exist. The highest level would be of a consistent solids modeler. This solids modeler would be capable of allowing the user to work with solids, surfaces, and/or wireframe without having to drop the solids modeling context.

In addition to the “exact” solids modeler, we would offer the user a conceptual modeling tool, one to be used for “what if” exercises. Offering a facetted representation, this modeler will offer almost instantaneous booleans, and virtually real-time hidden-line removal. This would be especially useful for the conceptual modeling stage where exact designs are not the primary focus. By tracking the design, the system will allow an automatic recreation of the model within ACIS, and allow the designer to polish and refine the model for further modeling/design/analysis work. This facetted modeler is now available and owned by Autodesk.

A 2D Region Modeler (“2D Solids”) would be available, allowing the user to define closed planar areas by solids modeling operations (join, difference, etc.). Full support for all wireframe geometry as bounding entities would be supported, including circles, ellipses, and splines. This will provide a more complete representation of objects in 2-D, permitting automated computation of geometrical characteristic such as area, perimeter, centroids and moments.

A translator which would automatically create complete solids models from multiple-view 2D drawings will be available. This would form an important link between the almost uncountable number of existing 2D drawings, and the world of high-end design. This product exists, but would have to be acquired.

A complete surface modeling system would be available, independently of the solids modeling system for those who were more “traditional” in their approach. Tools which allowed 3D-party access to this modeler could support modern machining applications which would compete favorably with those offered by the turnkey vendors.

An automatic mesher for closed 2D regions would be part of the modeling environment. This would allow for refinement of the mesh, application of loads, definition of constraints, and display of loaded results. In addition to an automatic data interface to popular high-end analysis packages, the system would provide a fast analyzer so that most of the analysis could be done without leaving AutoCAD Designer, thus completely closing the analysis loop. In addition, it will provide a sophisticated basis for 3d-party developers to build more advanced FEM support. The beginnings of this product now exist, although significant development would be required to turn this into a finished product.

A complete 2D variational design interface would be provided, allowing the user to specify designs by variable dimensions and/or constraints. This would allow the user great freedom in his/her ability to create families of parts, to quickly vary designs and see the results, and to create and animate designs for articulated mechanisms. Work on this product is proceeding.

A “poor-man's” parametric design system would be offered which allows the user to define a part parametrically by specifying dimensions symbolically, and attaching values to these dimension at insertion time. The process, which exists and is impressively simple yet surprisingly powerful, automatically generates an AutoLisp program which defines the geometry in terms of these variables. The system can prompt for the values of the variables, or accept default values from a file, creating a block for insertion into the drawing. This capability, with the name “GLISP” (for Generated AutoLisp), is soon to be marketed by our subsidiary in the United Kingdom.

The graphics pipeline of the AutoCAD Designer would support the widest range of display devices, including those capable of maintaining a complete copy of the 3D model internally. This would allow it to take direct advantage dynamic graphics, and internal rendering engines which are becoming increasingly more powerful, and increasingly less expensive.

While the lure of technology is sometimes difficult to resist, resist it we must. AutoCAD became successful through a dedication to providing useful and high-quality products, not by solving the industry's most difficult problems. In the same way, AutoCAD Designer must not be positioned to contain 100% of the capability of competing products. To attempt to do so would put us on the road of diminishing returns. The most technically “challenging” problems require far, far more resources to solve than the revenue one gains in return for it.

By being consistent with the AutoCAD philosophy, which has helped grow one of the industry's most successful companies, we will similarly be in a position to capture a majority of users in the Mechanical Design Automation market. Again, offering well-written, useful products, and providing capability which the user appreciates, succeeds far better than an avalanche of pure technology.

The future of AutoCAD will not be neglected. In addition to the large number of tasks to be undertaken to help maintain AutoCAD's predominant position in the world of drafting and drawing, AutoCAD would also benefit from the addition of a selected few of these technologies.

The 2D constraint manager, properly integrated, would seem to be an ideal tool for the 2D world, providing additional capability to achieve the goals of our users. The 2D-to-Solids translator also appears to be a natural for AutoCAD. Even without the ability to further manipulate this model, users would be able to easily and quickly see a fully rendered 3D representation of their 2D drawings, obtain cross-section data, generate sophisticated technical illustrations, and obtain mass properties. All of this would be useful, even if a user never explicitly modeled in 3D. Optional features for AutoCAD could include the NURBS-based surface modeler, the facetted conceptual solids modeler, and the ACIS modeler.

Enhancing the technological content of Autodesk's products is inevitable. Not only do our investors expect it, but our long-term financial health almost requires it. A company which remains stagnant, or which limits its own potential soon loses the confidence of the investment community, as well as those who make strategic decisions for their companies.

By adding this technology into AutoCAD itself we run the very real risk of alienating a large portion of our current users, and encouraging them to migrate toward CAD products which offer capability more precisely suiting their needs. If we were to abandon these users, who have been the foundation of our success, we would have no guarantee that our future success, being based on a user base which we do not understand well.

By differentiating our products, we can achieve the best of both worlds, providing additional leverage for AutoCAD in those environments whose purchases are motivated primarily by design considerations. In addition, the wide success of AutoCAD itself will provide the entry of the AutoCAD Designer into companies who are already familiar with Autodesk, introducing them to high end design, or displacing turnkey systems which are already there.

This strategy is an extension of the AutoCAD strategy. Autodesk has never attempted to solve all of the problems associated with design and manufacturing, in contrast to the turnkey approach. AutoCAD was a product which was narrowly focused to solve one of the stages of the process better and less expensively than the turnkey vendors could do it.

AutoCAD Designer should similarly be narrowly focused within the design stage of the process and not be afflicted by the “total solution” disease. By cooperating with our third-party developers, we will be able to cooperatively offer solutions which address the full range of the process, at a price irresistible to the user community.

Our primary strategic approach must include a firm, unyielding commitment to our current customer base; we must be totally unambiguous about our support of the technology in AutoCAD, and continue to be paranoid about satisfying those users' needs. We should also, however, take advantage of what I believe to be a rare opportunity to deliver a fatal blow to the turnkey vendors (and perhaps to PTC as well) by being a key player in the emergence of a new market for high-end design automation, where we are uniquely qualified to play.

The concepts in this paper have been presented to a variety of people, although in much less detail than they were presented here. This includes the Managing Directors of Autodesk subsidiaries and their marketing Directors, Autodesk Product Management, Autodesk Strategic Marketing and, with relatively uneven consistency and little discussion, to members of Autodesk management.

I would very much appreciate your comments.

|

|