« February 4, 2018 | Main | February 15, 2018 »

Saturday, February 10, 2018

Gnome-o-gram: Experts

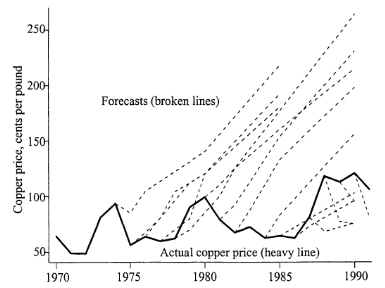

Ever since the 19th century, the largest industry in Zambia has been copper mining, which today accounts for 85% of the country's exports. The economy of the nation and the prosperity of its people rise and fall with the price of copper on the world market, so nothing is so important to industry and government planners as the expectation for the price of this commodity in the future. Since the 1970s, the World Bank has issued regular forecasts for the price of copper and other important commodities, and the government of Zambia and other resource-based economies often base their economic policy upon these pronouncements by high-powered experts with masses of data at their fingertips. Let's see how they've done. The above chart, from a paper [PDF] by Angus Deaton in the Summer 1999 issue of the Journal of Economic Perspectives shows, for the years 1970 through 1995, the actual price of copper (solid heavy line) and successive forecasts (light dashed lines) by the august seers of the World Bank. Each forecast departs from the actual price line on the date at which it was issued.

Over a period of a quarter of a century, every forecast by the World Bank has been totally wrong. Further, unlike predictions made by throwing darts while blindfolded, where you'd expect half to be too high and half too low, every single prediction from the 1970s until 1987 erred wildly on the high side, while every one after that date was absurdly pessimistic. You'd have made a much better forecast for the period simply by plotting a random walk between 50 and 100.

And yet people based decisions upon these forecasts, and those in the industry or who depended upon it for their livelihood suffered as a result. Did any of the “experts” who cranked out these predictions suffer or lose their cushy jobs? I doubt it.

In the investment world, firms and forecasters are required to warn potential customers that “past performance is no guarantee of future results”. But in a case like this, past performance is a pretty strong clue that the idiots who turned it in are no more likely to produce usable numbers in the future than a blind monkey firing a shotgun at the chart.

Now, bear in mind what Michael Crichton named the “Murray Gell-Mann Amnesia Effect”:

The above chart, from a paper [PDF] by Angus Deaton in the Summer 1999 issue of the Journal of Economic Perspectives shows, for the years 1970 through 1995, the actual price of copper (solid heavy line) and successive forecasts (light dashed lines) by the august seers of the World Bank. Each forecast departs from the actual price line on the date at which it was issued.

Over a period of a quarter of a century, every forecast by the World Bank has been totally wrong. Further, unlike predictions made by throwing darts while blindfolded, where you'd expect half to be too high and half too low, every single prediction from the 1970s until 1987 erred wildly on the high side, while every one after that date was absurdly pessimistic. You'd have made a much better forecast for the period simply by plotting a random walk between 50 and 100.

And yet people based decisions upon these forecasts, and those in the industry or who depended upon it for their livelihood suffered as a result. Did any of the “experts” who cranked out these predictions suffer or lose their cushy jobs? I doubt it.

In the investment world, firms and forecasters are required to warn potential customers that “past performance is no guarantee of future results”. But in a case like this, past performance is a pretty strong clue that the idiots who turned it in are no more likely to produce usable numbers in the future than a blind monkey firing a shotgun at the chart.

Now, bear in mind what Michael Crichton named the “Murray Gell-Mann Amnesia Effect”:

The next time you hear a politician, economist, or other wonk confidently forecast things five or ten years in the future, remember the World Bank and copper prices. Odds are the numbers they're quoting are just as bogus, and they'll pay no price when they're found to be fantasy. Who pays the price? You do.You open the newspaper to an article on some subject you know well. In Murray's case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the “wet streets cause rain” stories. Paper's full of them.

In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about Palestine than the baloney you just read. You turn the page, and forget what you know.