« April 14, 2021 | Main | April 16, 2021 »

April 15, 2021 Archives

Thursday, April 15, 2021

CONTINUITY: Rocket Lab’s CEO Peter Beck on Neutron, Electron Recovery, and Rocket Lab’s Future

TRACKING WITH CLOSEUPS: The Wolfram Physics Project: One Year Update

The @wolframphysics Project is one year old today---and things are going spectacularly! Not only do we seem to firmly be on the right track for fundamental physics, but our formalism also has immediate other applications...https://t.co/HlmHw4dEkz pic.twitter.com/23JpAzbbRv

— Stephen Wolfram (@stephen_wolfram) April 14, 2021

The linked article, “The Wolfram Physics Project: A One-Year Update”, is a long read (13,179 words), but well worth the investment of time. What Stephen Wolfram and his collaborators are attempting is breathtaking in its ambition and, if successful, profound in its implications for our understanding of the fundamentals of physics and perhaps much more.

I've long suspected that our “fundamental theories” such as quantum mechanics and general relativity were effective theories describing emergent phenomena from a much simpler, very different, and in all likelihood discrete underlying substrate, just as the Navier-Stokes equations of fluid mechanics describe behaviour which is entirely the consequence of electromagnetic interactions between molecules at a lower level, which could never be discovered by elaborating models of the emergent phenomenon. The Wolfram Physics Project is exploring very simple models which, they have discovered, manifest emergent phenomena which seem to exhibit properties like relativity and quantum mechanics, providing encouragement they're on the right track.

A vast collection of on-line resources is available at the Wolfram Physics Project Web site, and the book, A Project to Find the Fundamental Theory of Physics, is now available in a Kindle edition which is free for Kindle Unlimited subscribers.

In the article, I found the brief discussion of the possible applicability of multiway systems to economics fascinating.

A bit like in the natural selection case, the potential idea is to think about in effect modeling every individual event or “transaction” in an economy. The causal graph then gives some kind of generalized supply chain. But what is the effect of all those transactions? The important point is that there’s almost inevitably lots of computational irreducibility. Or, in other words, much like in the Second Law of Thermodynamics, the transactions rapidly start to not be “unwindable” by a computationally bounded agent, but have robust overall “equilibrium” properties, that in the economic case might represent “meaningful value”—so that the robustness of the notion of monetary value might correspond to the robustness with which thermodynamic systems can be characterized as having certain amounts of heat.

This is similar to what I (reluctantly) called “Quantum Economics” in my 1988 paper, “The New Technological Corporation”.

We construct aggregates to approximate the behaviour of large numbers of discrete interactions. Sometimes they are useful, as in thermodynamics. Often they aren't, as with most macroeconometric measures. Wheeler suspects that all our laws of physics describe approximate behaviour of aggregates of observations; that the fundamental quantum event is all that really exists. Most of physics does not attempt to understand why these quantum events occur but simply describes the aggregate behaviour of large numbers of events. As we begin to understand the low-level mechanisms, we will get to the true physics beneath the aggregates. Similarly, in economics we try to predict behaviour of aggregates of individual transactions. Only the transactions are real; all the rest is the work of man. One may not be able to understand what drives the transactions by theorising based upon aggregates.

Parallels exist between markets and quantum mechanics. The electron has no position or momentum until you measure it. When you measure its position, you disturb it, forgoing accuracy in measuring the momentum. A share of General Motors has no price until a buyer and seller exchange it, a discrete event. This transaction/measurement affects the price of subsequent transactions. Prices are undefined until a transaction occurs, whether the purchase of a loaf of bread or the takeover of RCA by GE. Prices in a large liquid market can be predicted quite well since the effect of a single transaction is minuscule; prices in blockbuster transactions can barely be predicted at all. Similarly, you can predict interference fringes to many decimal places but which detector an individual electron will trigger in a dual slit interference experiment is unknowable in principle.

Just as Wolfram argues may be the case for physics, generations of economists have been struggling with effective theories based upon aggregates rather than getting down to the individual transactions, which is the bottom-level reality (what Wolfram calls the “machine code”) that their aggregates and abstractions will never discover.

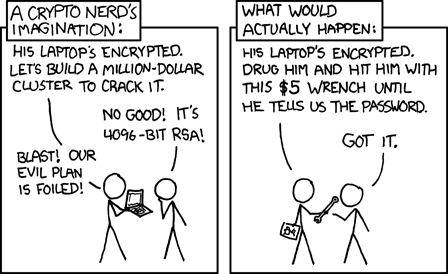

CONTEXT: Brute-Forcing a 256 Bit Encryption Key

Brute-forcing a 256-bit key would require a minimum energy of 590000000000000000000 Suns during 1 year! pic.twitter.com/9UmnDkbcqb

— Fermat's Library (@fermatslibrary) April 14, 2021

But remember: